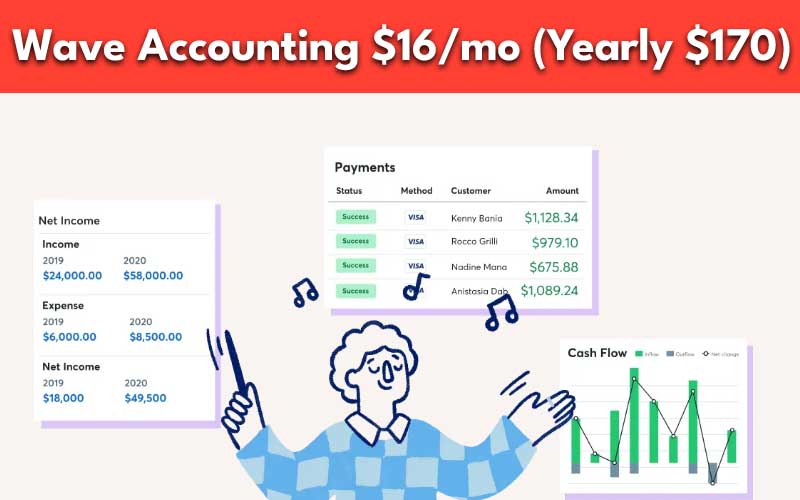

Wave is a cloud-based accounting software designed to streamline bookkeeping, invoicing, and payment processes. It enables users to create and send unlimited bills and invoices, manage invoices via its mobile app, and generate financial reports. One of Wave’s strengths is its ease of setup and availability of a free plan suitable for basic accounting needs.

However, it lacks advanced features such as project management and inventory accounting. Users can opt for the free Starter plan or upgrade to the Pro version for $16 per month. In this article unlock insights with a detailed Wave Accounting review, covering features, usability, pricing, and user experiences.

Pros

- Completely free-for-life accounting software plan.

- Below-average starting price for Wave’s paid accounting plan.

- User-friendly browser interface and mobile accounting app.

- Unlimited invoicing, expense tracking and billable clients.

- Multi-business management.

Cons

- No built-in third-party app integrations.

- Fewer accounting features than competitors like QuickBooks.

- Customer service through chat or email only.

| Deciding Faqtors | |

|---|---|

| Pricing | Starter: Free (one user only) Pro: $16 per month or $170 per year (unlimited users) |

| Discount | Discounted credit card processing fees for Pro users: 2.9% plus $0 (Visa, Mastercard, Discover) 3.4% plus $0 (Amex) Standard rates:2.9% plus 60 cents (Visa, Mastercard, Discover) 3.4% plus 60 cents (Amex) |

| Payroll | Available through Wave Payroll (read our review of Wave Payroll for more information) $40 per month plus $6 per employee for users in New York, Florida, Georgia, Illinois, Arizona, California, Indiana, Virginia, Washington, Minnesota, North Carolina, Texas, Tennessee, and Wisconsin $20 per month plus $6 per employee for the remaining 36 states |

| Standout Features | Optical character recognition (OCR) in receipt scanning Sales tax in invoices, bills, and estimates Easy to set up and use Customer profiles to track the status of invoices Unlimited receipt capture in the paid plan |

| Scalability | Limited with the free plan; supports only one user Moderate with the paid version; can add as many users as needed but lacks advanced features for growing businesses |

| Ease of Use | Extremely easy to use; has a simple and user-friendly interface |

| Customer Support | Starter: Includes self-help and chatbot; live chat and email support is added when you purchase a paid add-on, such as receipt capture and Wave Payroll Pro: Live chat and email support included |

| Average User Reviews | Mostly positive; praised for its simplicity and affordability |

Best For

• For service-oriented businesses in need of a no-cost solution for basic accounting, Wave’s free plan offers ample features like invoicing, income and expense tracking, and reporting, making it our top recommendation for free accounting software.

• If you’re searching for an affordable receipt scanning solution, Wave’s paid version priced at $16 monthly provides unlimited receipt capture and scanning capabilities with OCR technology and unlimited cloud storage, making it one of the best receipt scanner apps available.

• Businesses conducting numerous small credit card transactions can benefit from Wave’s Pro plan, which waives the 60-cent fee per transaction. While this fee may not seem significant for larger credit sales, it represents substantial savings for businesses with frequent small credit transactions.

• Small businesses with employees can leverage Wave’s paid version, which integrates seamlessly with Wave’s payroll software, enabling efficient management of employees, timesheets, and payroll transactions.

Wave Reviews From Users

Pros

- Record the screen of the target device with the screen recorder.

- Get full access to your target’s call log and location.

- See texts, even the deleted ones.

- View all the pictures and videos on their device.

- The keylogger tracks everything typed, even if it’s deleted.

- Get alerts for flagged words with the keyword alert feature.

- Real-time location tracking plus alerts if they go into a certain area.

Cons

- No free trial or plan.

- The iOS installation process can be a bit tricky.

- You need a separate subscription for each device you want to track.

Here are the user reviews we collected and our expert opinions:

• Setup Simplicity: Reviewers appreciate Wave’s user-friendly interface, making setup effortless even for beginners. I concur that Wave remains exceptionally easy to set up and navigate, even with the new paid version.

• Basic Accounting Features: Users praise Wave’s free plan for its comprehensive basic accounting features, such as invoicing and expense tracking. However, it’s worth noting that bank account connections are no longer available in the free plan, which could be disappointing.

• Inclusive Payroll: One reviewer highlights Wave’s inclusion of built-in payroll, either as a paid add-on in the free plan or as part of the paid version, which is appreciated.

• Invoice Customization Limitations: Some users express disappointment in the limited invoice customization options. While Wave allows for basic customization like uploading a company logo and choosing a theme color, more advanced customization features are available in the paid version.

• Customer Support Accessibility: Criticism arises regarding the absence of customer support options in the free plan, except for paid subscribers. However, the inclusion of free live chat and email support in the new paid version is seen as a positive improvement.

Fit Small Business Case Study

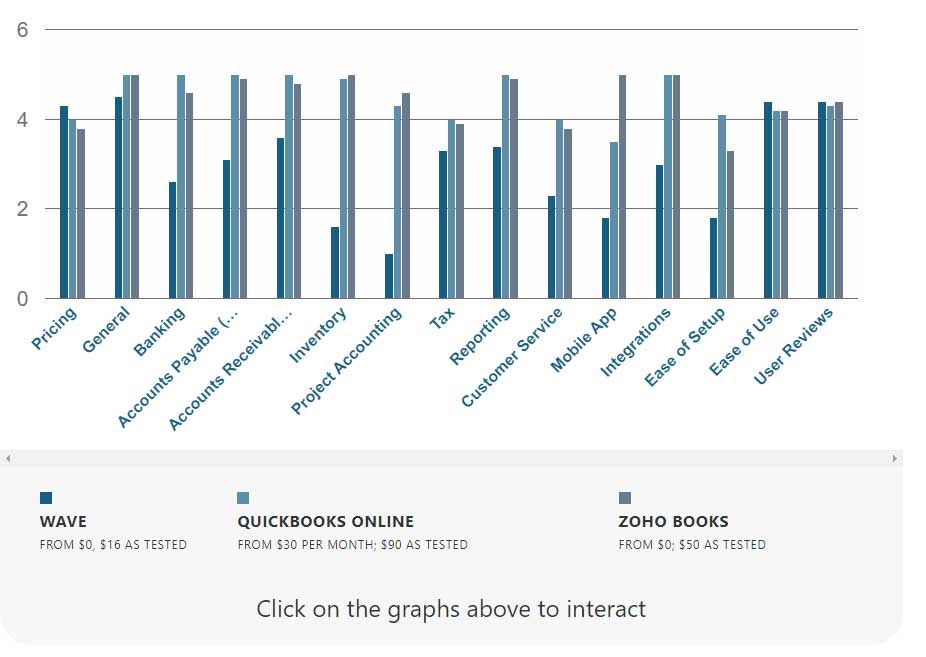

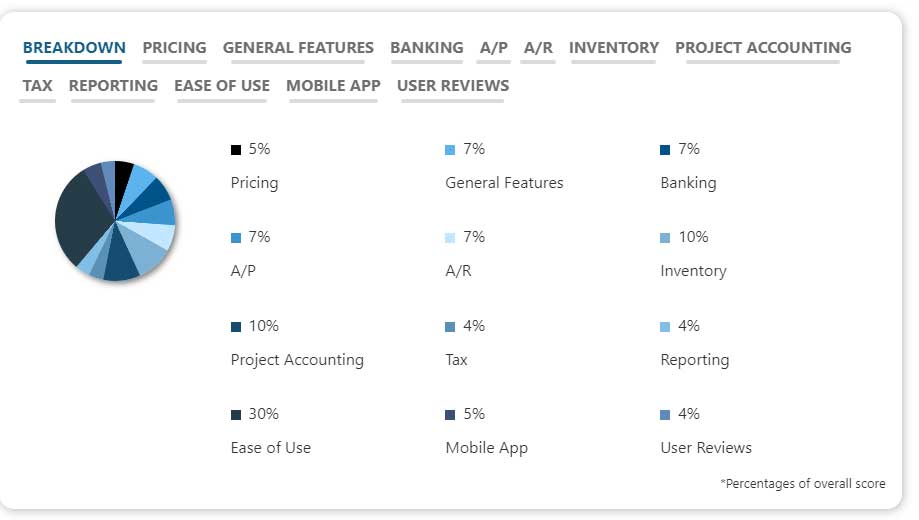

We’ve conducted an internal case study to assess accounting software in 15 categories using a standardized set of facts and functions. The graph below illustrates Wave’s performance in each category compared to two competitors, QuickBooks Online Plus and Zoho Books. Further details explaining the scores are provided in the Features section.

Wave vs Competitors FSB Case Study

Wave Accounting Features

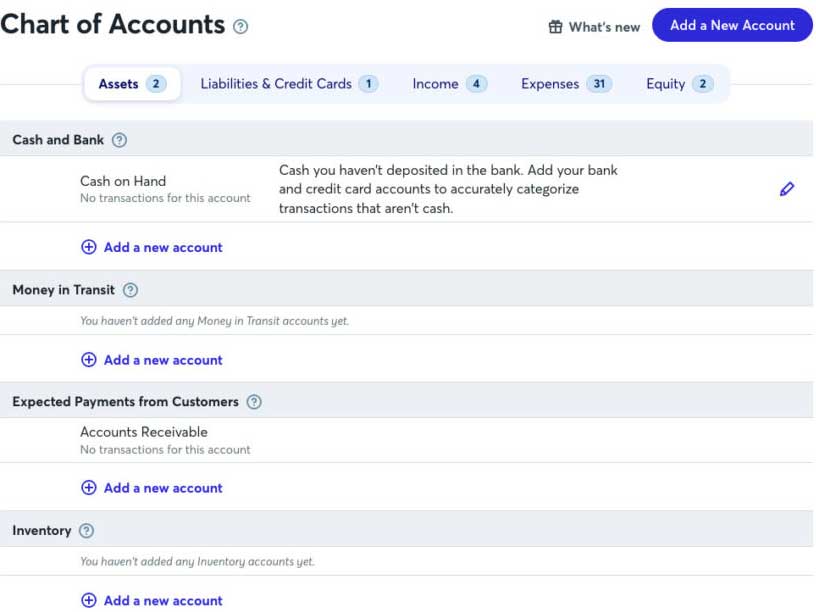

Wave received high scores for its general features, although it missed out on a perfect score due to limitations in using account numbers in the chart of accounts and importing a chart of accounts. Nonetheless, we appreciate Wave’s quick setup process for new accounts and the ease of adding business information such as company name, business type, address, and contact details.

By default, Wave sets up your chart of accounts based on common accounts and categories. However, you have the flexibility to add other accounts as needed. To add an account, navigate to the Chart of Accounts page under the Accounting menu and select the appropriate tab at the top of the page for the account or category you want to add.

1. Banking and Cash Management

In the paid version of Wave, you have the option to link your bank account and upload bank statements to sync your transactions. However, Wave’s reconciliation feature isn’t as smooth as some other software, like QuickBooks Online. Although it offers automatic reconciliation, it lacks the ability to include reconciling items, such as checks that are written but not yet processed by your bank.

Unfortunately, the free Starter plan doesn’t permit live feed connections to bank or credit card accounts. Nevertheless, you can still upload your bank statements from CSV or Excel files and carry out bank reconciliations manually.

2. A/P

Wave stands out as one of our top Accounts Payable (A/P) software options, particularly because it allows users to record unpaid bills even with the free Starter plan. However, we did identify some weaknesses, including the inability to generate purchase orders, track transactions by vendor, and attach receipts to unpaid bills.

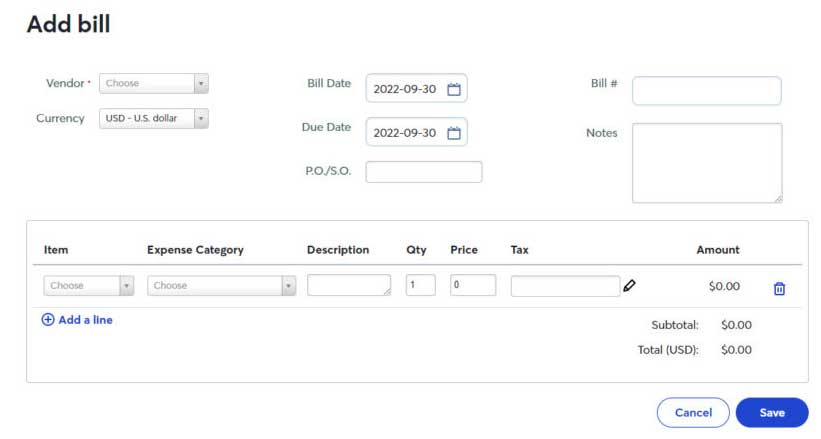

Despite these shortcomings, we’re impressed by Wave’s user-friendly interface, making it easy to manage unpaid bills. The Purchases menu houses all the necessary features for recording purchases, including Bills, Vendors, and Products and Services.

Depending on your subscription level, you can conveniently snap a photo of your expense receipt using the mobile app and upload it to Wave. While all users can attach receipts to transactions within the desktop interface, this feature isn’t available for unpaid bills.

To record a bill in Wave, simply click on the “Create a Bill” button, which will prompt the “Add bill” screen to appear.

Regrettably, Wave doesn’t offer the ability to create recurring transactions directly from bills, a feature available in other software like QuickBooks. Additionally, you can’t generate recurring expenses or create and send purchase orders (POs) within Wave’s platform.

3. A/R

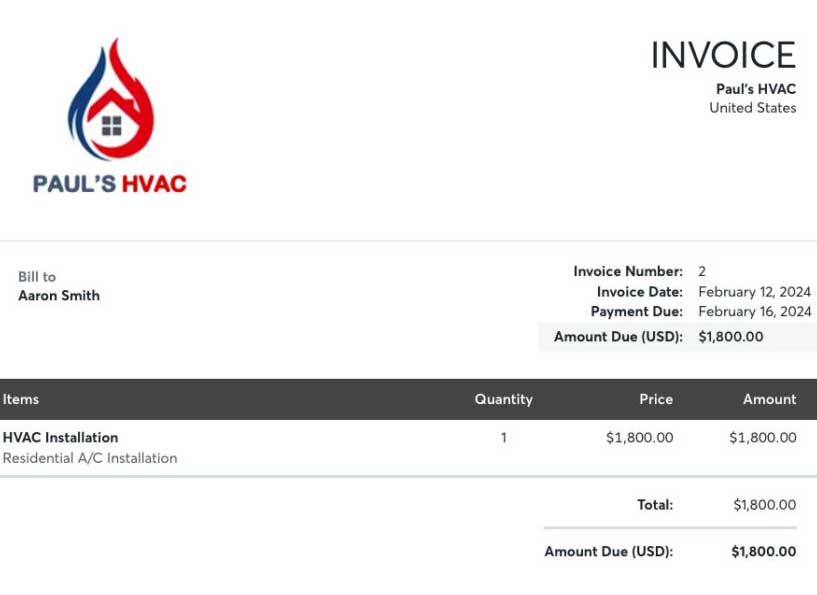

Wave performed admirably in Accounts Receivable (A/R) management, although its score could have been higher if it offered more customization options for invoices. While the Starter plan permits uploading your company logo, it lacks the ability to choose from invoice templates or change invoice colors.

The Pro plan does provide more flexibility in creating invoices, but they still aren’t as customizable as those offered by other software such as QuickBooks Online.

In the paid version of Wave, once you’ve created an invoice, you can conveniently email it directly to your customer. However, this feature isn’t available in the free plan. Instead, the free plan provides a link to your invoice, allowing you to include it in your own email.

Additional tasks you can accomplish in Wave’s Accounts Receivable (A/R) system include:

- Setting up recurring invoices for regular billing cycles.

- Creating product or service items to auto-fill invoices, streamlining the billing process.

- Easily viewing outstanding invoices without needing to generate a separate report.

- Tracking sales tax collected and remitted by jurisdiction.

- Accessing detailed tax reports for comprehensive financial insights.

4. Project Accounting

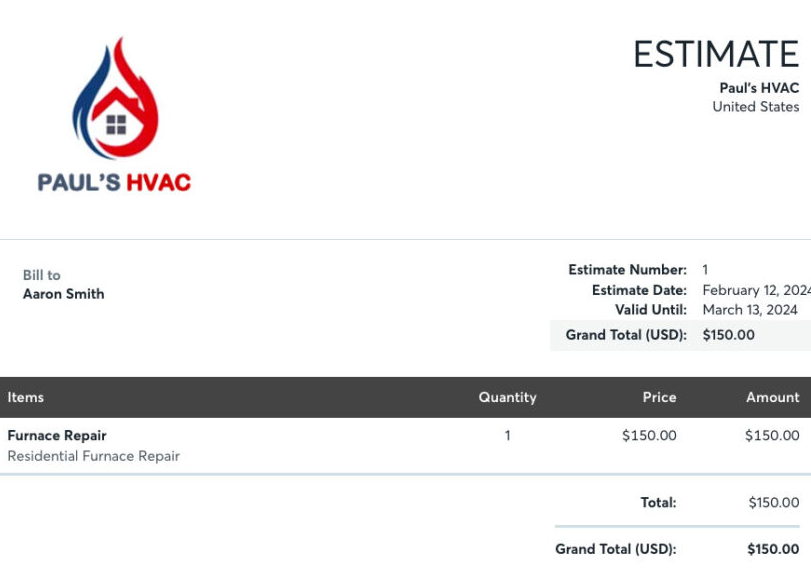

Wave may not be the best fit for contractors and businesses requiring project management features. It lacks the ability to set up projects and assign them to team members, thus hindering the tracking of actual income and expenses by projects. Instead, Wave only allows for the creation of customized estimates, which can be sent to new or prospective customers.

While you may find Wave’s estimate feature helpful, we recommend exploring our list of the best contractor accounting software for more comprehensive project accounting features. These options are specifically tailored to meet the needs of contractors and offer a wider range of project management capabilities.

5. Sales & Income Tax

Wave provides the functionality to include sales taxes on invoices, bills, estimates, and income and expense transactions. When you input a transaction involving sales tax, Wave automatically records the amount in the sales tax liability account.

However, while you can track your sales tax within Wave, the platform does not offer the capability to file returns or pay your tax liability directly. This feature is particularly useful if you work with independent contractors and need to generate 1099 forms for tax filing purposes.

Keep in mind that the sales and income tax features are assessed across other categories, and there is no separate video for this specific feature.

6. Inventory

Wave’s inventory management feature is quite basic, so if you operate a product-based business, you may want to explore alternatives like QuickBooks Online or Xero. While you can add a product or service in Wave, you cannot track the quantity purchased or sold.

As a result, Wave cannot calculate your Cost of Goods Sold (COGS), which is crucial for businesses dealing with inventory.

Our evaluation of Wave’s inventory management feature was primarily conducted across other categories, particularly Accounts Receivable (A/R) and Accounts Payable (A/P), so there is no separate video specifically dedicated to inventory management

7. Reporting

Wave receives high marks in this category due to its strong reporting capabilities. We attempted to generate 16 types of reports and successfully generated the following: profit and loss (P&L) statement, cash flow statement, accounts payable (A/P) aging, accounts receivable (A/R) aging, general ledger, trial balance, transaction list by customer, and expense by vendor.

However, despite these successes, Wave’s reporting feature lacks the ability to customize reports according to user preferences. Additionally, it does not offer some desired reports, which could be a drawback for users with specific reporting needs.

8. Mobile App

Wave recently integrated its Wave Receipts app with the Wave Accounting app, streamlining functionality into a single application. While this consolidation benefits users by eliminating the need for separate apps, it’s important to note that the combined app still has limited features.

In the new setup, free plan users will need to subscribe to Wave Receipts, while it’s included in the paid Pro plan. The app primarily handles basic tasks such as sending invoices, receiving payments, and capturing expense receipts.

However, it lacks features like bill input and payment, bank transaction categorization, and report viewing. This limitation could pose challenges for users who frequently conduct business on the go.

Wave Accounting Integrations

Wave experienced a setback in integrations due to its inability to connect with time tracking and electronic bill pay processors directly. While it offers direct integration with Google Sheets and BlueCamroo, integration with other applications must be done through Zapier. Users with a Zapier subscription can leverage a wide range of ecommerce apps for integration.

Additionally, Wave integrates seamlessly with its own suite of products, including Wave Payroll, Wave Invoicing, Wave Payments, and Wave Money. Furthermore, Wave users have access to Wave Advisors, an assisted bookkeeping service, providing additional support and expertise.

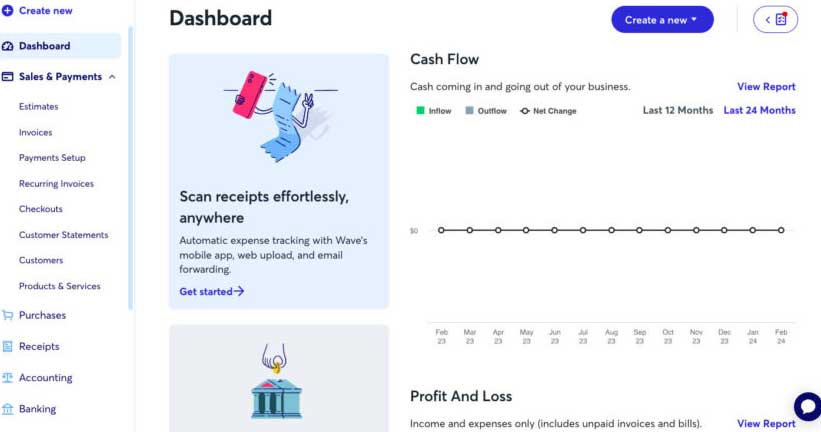

Wave Accounting Ease of Use

Wave is renowned for its user-friendly interface and low learning curve, regardless of whether you’re using the free or paid version. The interface is clean and intuitive, making navigation straightforward. In the dashboard, you’ll find shortcut buttons that allow you to create new transactions, such as bills, estimates, and invoices, with ease.

Even for users without prior accounting experience, Wave is easy to grasp, and you can become familiar with its features in less than a week. Its simplicity and accessibility make it a popular choice for individuals and businesses alike.

Wave Accounting Customer Support

Wave offers limited customer service in its free plan, with support primarily provided through an automated chatbot or self-help resources. Access to email and live chat support is available as an add-on in the free plan or included in the paid version.

For personalized support, users can opt for the Wave Advisor program, which provides coaching and year-round advice from a Wave expert. However, these support services come at a cost that may be prohibitive for many small businesses. As such, we hesitate to fully recommend them unless you have a budget to spare.

Wave Accounting Assisted Bookkeeping Options

The Wave Advisor program offers comprehensive bookkeeping, accounting, and tax services directly from Wave. Trained Wave employees, known as Wave Advisors, are available to assist you with your bookkeeping needs. The program offers two main packages:

Bookkeeping Support:

- Price: $149 per month

- Description: With this package, dedicated Wave Advisors will handle all your bookkeeping needs each month. You can rest assured knowing that your bookkeeping tasks are taken care of by professionals.

Accounting and Payroll Coaching:

- Price: One-time payment of $379

- Description: Unlike the bookkeeping support package, this option involves a one-time payment. It is ideal for business owners or freelancers who prefer to manage their bookkeeping independently. Wave Advisors will provide training in accounting and payroll, empowering you to handle these tasks yourself for your business.

If you have a busy schedule and prefer to have professionals manage your bookkeeping, we recommend opting for the bookkeeping support package. However, if you’re someone who prefers to handle bookkeeping tasks yourself and wants to gain confidence in accounting and payroll management, the coaching package may be more suitable for you.

How We Evaluated Wave

We conducted an evaluation of Wave using an internal scoring rubric consisting of 15 major categories.

Bottom Line

Despite its limitations, Wave remains a valuable option for small businesses. It provides essential functionality to pay bills, invoice customers, and track expenses, even within the free Starter plan. However, for access to live customer support, upgrading to the Pro plan for $16 per month is necessary.

Frequently Asked Questions (FAQs)

Yes, Wave continues to provide a free plan, albeit with limitations such as being restricted to a single user. If you require the ability to add multiple users, you will need to opt for the paid version, priced at $16 per month.

Indeed, Wave prioritizes data security by employing 256-bit Transport Layer Security (TLS) encryption. All accounting data are securely stored on servers monitored 24/7 to ensure their safety. Additionally, Wave does not store credit card numbers, adding an extra layer of protection for sensitive information.

Yes, Wave provides payment processing services through Wave Payments, with fees based on transaction volume. For Visa, Mastercard, and Discover transactions, the standard fee is 2.9% plus 60 cents per transaction, while American Express transactions incur a fee of 3.4% plus 60 cents.

However, upgrading to the Pro plan offers discounted rates: 2.9% plus 0 cents for Visa, Mastercard, and Discover transactions, and 3.4% plus 0 cents for American Express transactions.

For more detailed information on its features and functionality, you can refer to our review of Wave Payments.

Indeed, Wave includes a robust sales tax tracking feature. Users have the ability to set up multiple sales tax rates, which can then be applied to invoices as needed. Additionally, Wave facilitates tax compliance by allowing users to generate reports specifically designed to assist with tax-related tasks.

Meet Ay Lin, your tech-savings buddy! Discover awesome lifetime deals on digital products without any fuss. Ay Lin makes it easy-peasy to upgrade your digital game without emptying your wallet. Join the savings journey and elevate your digital experience effortlessly!