FreshBooks is a handy accounting app made for small businesses with less than 50 employees. Its user-friendly interface makes it perfect for users who aren’t too familiar with accounting. If you’re a freelancer just starting, FreshBooks is great for managing invoices and accounts easily. If you want to know details about FreshBooks then please read our full FreshBooks review.

FreshBooks Review Summary

FreshBooks, a cloud-based accounting software company, was founded by Michael McDerment in 2003. Currently, over 100,000 customers rely on FreshBooks for their accounting and invoicing needs. It’s customized specifically for small and micro businesses, featuring a simple interface and user-friendly experience.

This app is best suited for small service-based businesses, as FreshBooks openly acknowledges that it may not meet the needs of larger companies or those with specific requirements. Its features include invoicing, payments, expense tracking, estimates, time tracking, project management, and a basic client CRM system.

Additionally, there are various reports available for invoicing, expenses, payments, accounting, and time tracking.

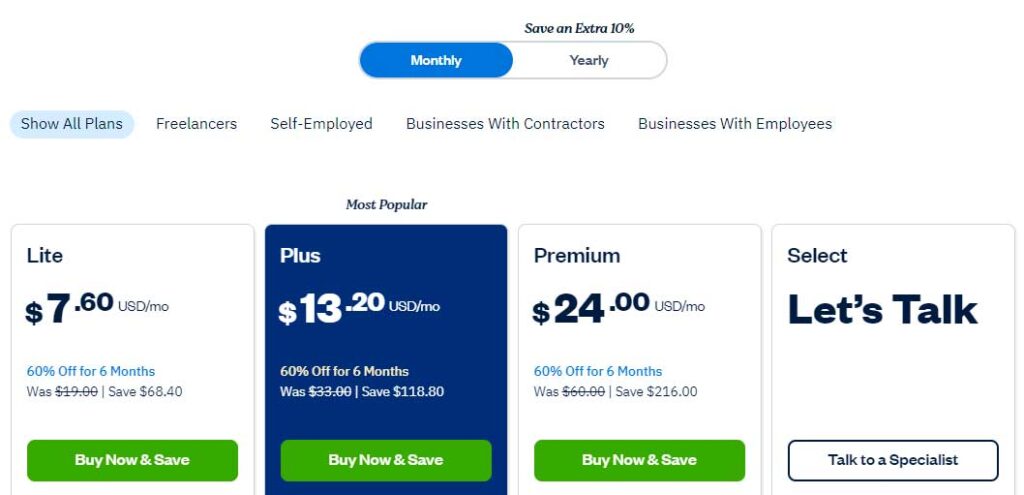

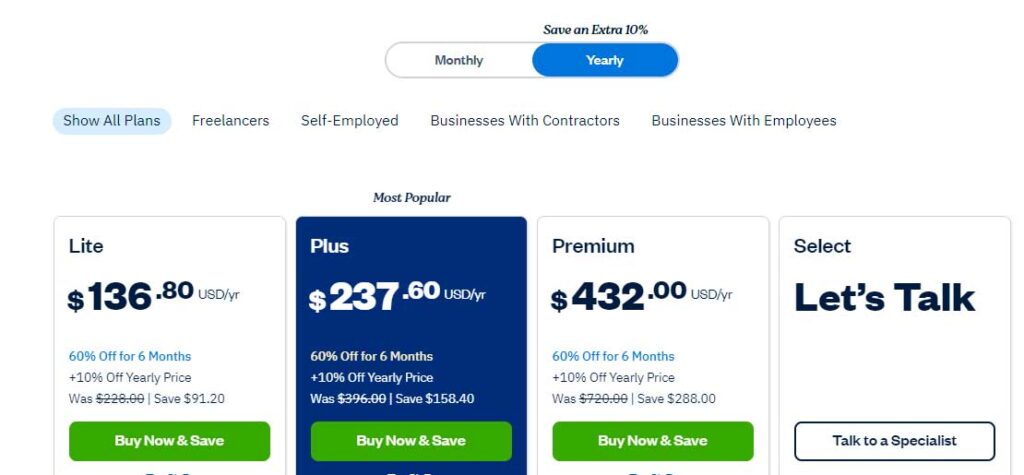

FreshBooks offers pricing plans ranging from $15 to $50 per month. The Premium Plan stands out for offering unlimited clients, whereas the other plans have limits on billable customers.

Adding advanced payments or extra team members will increase the monthly cost by $10 to $20. There’s also a free trial allowing users to test FreshBooks for 30 days.

Overall, FreshBooks is highly recommended for small or micro businesses due to its intuitive and user-friendly nature. However, it may not be as suitable for businesses requiring advanced inventory management features.

For those seeking more sophistication or dealing with extensive inventory and clients, alternatives like QuickBooks or Zoho Books are suggested.

FreshBooks Pricing & Cost

FreshBooks offers pricing plans starting at $15 per month for the Lite Plan and going up to $50 per month for the Premium Plan. If your business requires specialized features, FreshBooks can create a custom plan for you. Additionally, there’s a slight discount on the monthly cost if you opt for a yearly plan.

Considering the client limits associated with each plan, we suggest the Premium Plan since it allows you to bill an unlimited number of clients. This ensures flexibility and scalability for your business without worrying about exceeding client limits.

Lite Plan

- $15 per month

- Unlimited invoices for 5 clients

- Track expenses

- Send estimates

- Track sales tax

- Mobile application access

Plus Plan

- $25 per month

- Bill up to 50 clients

- Recurring billing features

- Run business health reports

- Invite accountant to access

- Double-entry accounting reports

Premium Plan

- $50 per month

- Unlimited clients

- Customized email templates

- Accounts payable capabilities

- Late payment reminders

- Track projects and profitability

FreshBooks Key Features

In this review, we’ll share the features provided by FreshBooks and assess its usability. We’ll also touch upon its market value and the quality of customer service offered by the company.

Additionally, we’ll include images of the software to provide you with a visual understanding of the FreshBooks experience.

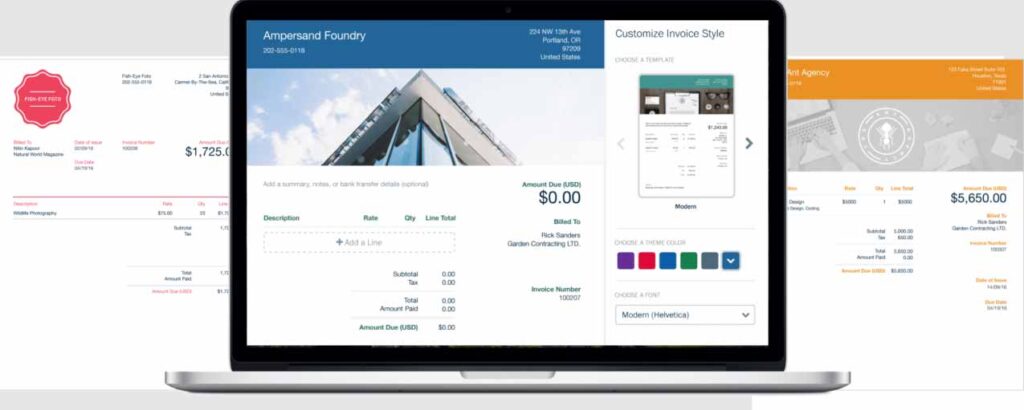

1. Invoicing

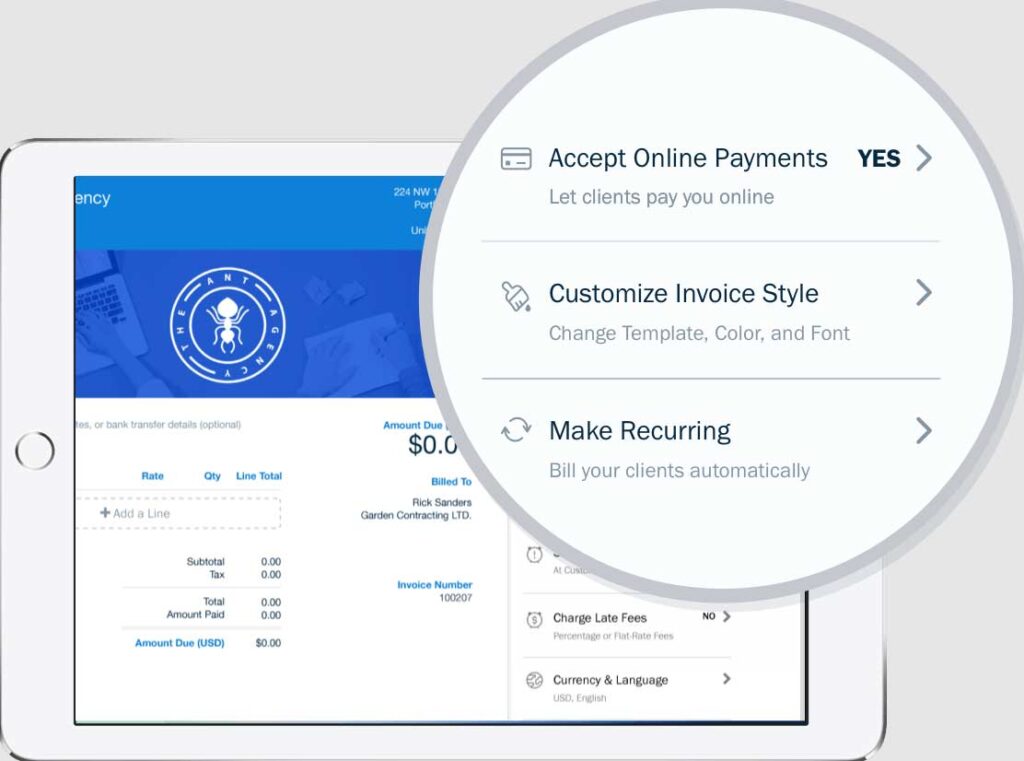

FreshBooks is really great when it comes to making invoices. It’s quick and easy to create them, and they’re sent out accurately and right away. You can customize each invoice with your own style, set up automatic reminders for payments, add late fees if needed, and even choose different currencies.

Plus, you can add your company logo, pick clients from your list, and include all the details for each item. You can also add taxes to each item, which is made easier if you set up tax categories beforehand. This means you don’t have to keep entering the same tax information over and over again.

In addition to the above features, you can also include the following elements in your invoices:

- Discounts

- Payment schedules

- Notes

- Terms of payment

- Deposit requests

- Attachments

You have the flexibility to send invoices via email or generate a shareable link for your clients. Regardless of your chosen method, you can personalize the email using dynamic fields.

These fields fill in the information for both the invoice and email, making it easier and letting you automate your invoicing.

With FreshBooks, you can create invoices individually or set up recurring invoice templates that are sent at regular intervals. This feature ensures consistency and efficiency in your invoicing process.

Recurring Invoices

For businesses with repeat customers who regularly purchase services, recurring invoices are a valuable tool. You can save recurring templates in FreshBooks, ensuring that relevant clients receive invoices automatically.

Creating these templates follows a similar process to regular invoices, but with recurring invoices, you can schedule issue dates, set the frequency of sending, and establish a limit on the number of invoices sent.

During our testing of recurring templates, we observed prompt delivery to clients, with all the necessary information accurately included.

Clients receive an email containing the invoice, allowing them to view it, communicate with your business via email, and make payments conveniently.

Invoices Sent to Your Business

In FreshBooks, there’s a convenient section where you can monitor invoices sent to your business by other FreshBooks users. This acts as a record of what you owe to other businesses.

2. Time Tracking

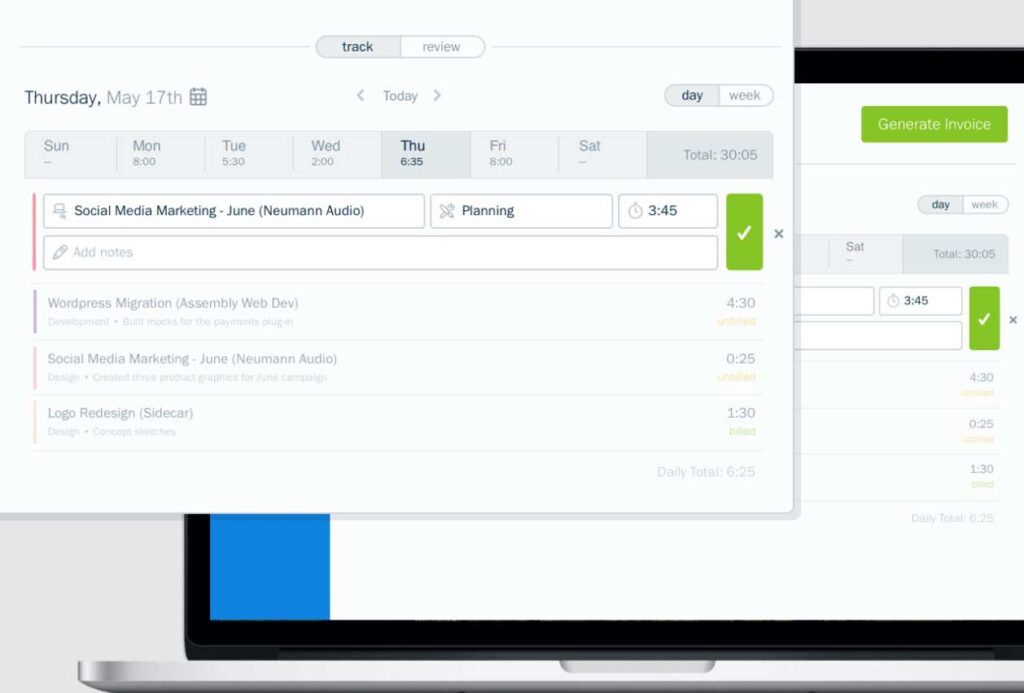

The time tracking feature in FreshBooks enables you to monitor time spent on tasks and bill clients accordingly. You have the option to track your work in real-time using a timer for precise records or manually add entries after completing the tasks.

While this section provides basic functionality, it meets the needs of most small businesses for tracking project time. A helpful aspect is the ability to generate and send invoices directly from this section, streamlining the process and saving time typically spent navigating through different parts of the tool.

Timed Entries

To begin timing your projects, simply click on the “Start Timer” button within the Time Tracking tab. This action will open a small window in the bottom right corner, as illustrated in the image below. Next, you’ll select the client for whom the work is being done, add the specific service you’re working on, and provide a brief description of the task.

Once you’ve completed the work, click “Stop” to save the timed project as a line item. When you’re ready to bill the client for the completed work, just click on “Generate Invoice,” and FreshBooks will automatically create the invoice for you. This streamlined process simplifies invoicing and saves you time.

3. Payments

FreshBooks provides a standard payment options for your convenience. You can accept payments via credit cards, bank transfers, and SEPA.net.

For credit card payments, FreshBooks facilitates transactions from major providers such as Visa, Mastercard, Discover, American Express, and ApplePay, with a fee of 2.9% plus 30 cents per transaction.

Bank transfers incur a 1% Automated Clearing House (ACH) charge, while payments through SEPA.net are subject to a 1% fee plus 0.25 Euro per transaction. Furthermore, FreshBooks allows integration with Stripe and PayPal for accepting payments, both of which charge a 2.9% fee along with a 30 cent transaction fee.

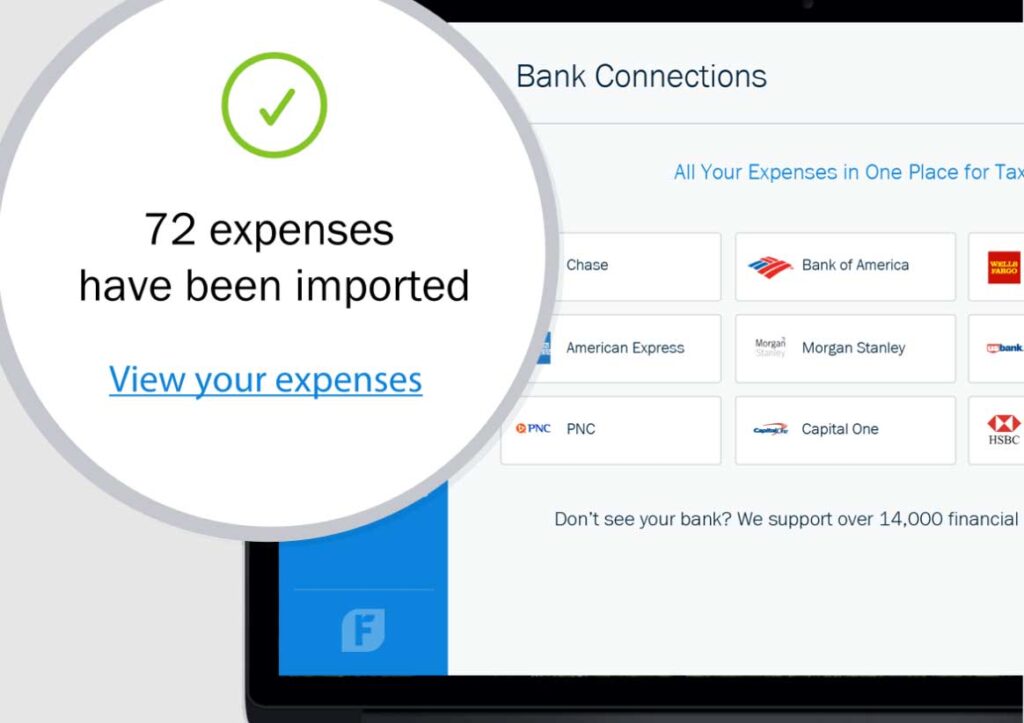

4. Expenses

In addition to tracking sales through invoices, FreshBooks allows you to monitor your business expenses efficiently. Adding new expenses is straightforward: you can input the merchant and description, attach a receipt image for verification, and include relevant taxes.

Moreover, you have the option to categorize expenses under various pre-selected categories provided by FreshBooks.

Although this section offers basic functionality, it provides sufficient detail for accurate expense tracking. The ability to attach receipt images proves particularly useful.

However, it’s worth noting that this feature is not as advanced as in other tools like Zoho Books, which automatically extracts information from receipt images to populate expense reports.

5. Accounting & Accounting Reports

FreshBooks simplifies the process of generating accounting reports by gathering data from invoices, payments, expenses, and your bank account. Additionally, FreshBooks offers the functionality to invite your accountant to access your account.

While this feature might not be as powerful as some other accounting software tools, it does the job well enough for small service-based businesses.

Double-Entry Accounting

FreshBooks provides double-entry accounting functionality, enabling you to track both aspects of a transaction for accurate bookkeeping. This feature offers deeper insights into your financial performance and helps identify areas for cost reduction.

Here’s a list of components categorized under double-entry accounting in FreshBooks:

- Cost of Goods Sold

- Other Income

- General Ledger

- Trial Balance

- Chart of Accounts

- Accountant Access

- Bank Reconciliation

- Balance Sheet

Invite Your Accountant

Many businesses find it beneficial to enlist the expertise of an accountant to oversee expense management and tax obligations. With FreshBooks, you have the option to grant your accountant access to your reports and data.

This enables them to manage your chart of accounts, view reports, and create journal entries for annotations throughout the year.

By providing your accountant with access to FreshBooks, you can collaborate and ensure accurate financial management.

Accounting Reports

Below is a table outlining the accounting reports that FreshBooks generates for your business. While FreshBooks may offer fewer pre-built reports compared to more advanced tools, it includes the most crucial information essential for most businesses.

| Accounting Report | Description |

|---|---|

| (A) Balance Sheet | A breakdown of your company’s assets, liabilities, and equity |

| (A) Profit & Loss | Shows what you owe and if the company is bringing in more money than it’s spending |

| (A) Cash Flow | The cash coming into and out of your business |

| (A) General Ledger | A bookkeeping tool where all accounting data is aggregated |

| (A) Trial Balance | This shows whether your books are balanced |

| (A) Bank Reconciliation Summary | Displays FreshBooks entries and transactions that haven’t yet been reconciled |

Tax & Finance Reports

In addition to generating accounting reports, FreshBooks also produces tax and finance reports designed to assist you in managing and comprehending your business operations, particularly in preparation for tax time.

These reports offer valuable insights into your business, such as identifying aging accounts receivable that require attention. By leveraging these insights, you can gain a deeper understanding of your financial situation and make informed decisions to enhance your business’s performance.

| Report | Description |

|---|---|

| (T) Sales Tax Summary | Gives a breakdown of the taxes you owe |

| (F) Accounts Aging | See the payments that are taking a while |

| (F) Accounts Payable Aging | Determine how much you need to pay your vendors |

| (F) Payments Collected | Provides an overview of the payments collected during a certain period of time |

| (F) Credit Balance | A summary of your credit balance for clients during a certain period of time |

| (F) Expense Report | See where you’re spending your money |

| (F) Revenue by Client | A breakdown of each client’s payments and the revenue you make from them |

| (F) Invoice Details | Provides metrics about all invoices over a certain period of time |

In addition to core financial reports, FreshBooks provides insights into time tracking, profitability, and retainer information, aiding in comprehensive business analysis and decision-making.

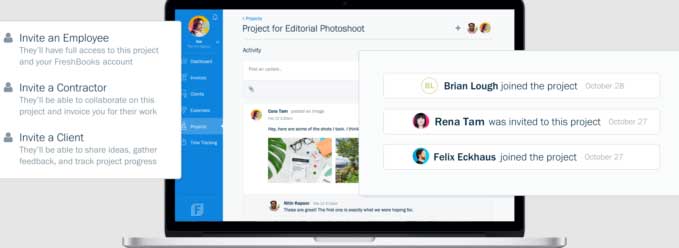

6. Projects

The ability to track individual projects is invaluable for those who need to monitor time spent on specific tasks. This feature is particularly beneficial as not all accounting tools offer project tracking capabilities.

You can set up hourly or flat-rate projects in FreshBooks and include services, team members, expenses, and other details. This feature is especially useful for businesses that offer ongoing or long-term services, rather than one-time projects.

Additional Features

Here’s a brief table outlining additional features offered by FreshBooks:

1. Dashboard

When you log into FreshBooks, the dashboard shows you important graphs about your earnings, profits, and other important numbers. This high-level overview of your business finances allows for quick insights, enabling you to stay informed about your financial status at a glance.

2. Client CRM

FreshBooks offers the convenience of importing and exporting CSV files containing customer and client information. Additionally, you have the flexibility to add clients individually, as well as vendors, providing seamless management of your contacts within the platform.

3. Team Members

In FreshBooks, you can easily add your company’s employees, your accountant, and any contractors you collaborate with. You have the option to set their billable rates, roles, and include basic contact information for efficient management of your team and external partners.

4. Integrations & Third-Party Tools

FreshBooks offers integrations with third-party vendors like Bench, Gusto Payroll, and FreshBooks Payments, among others, enhancing its functionality and flexibility.

5. Estimates

Sending estimates or proposals to clients allows you to outline your prospective services and charges. In FreshBooks, converting an accepted proposal into an invoice is effortless, requiring just a few clicks for seamless transition.

FreshBooks Customer Support

The FreshBooks team is readily available from 8AM to 8PM EST on weekdays, ensuring accessibility for customers. Their commitment to prompt support is evident, with responses to support emails typically within three hours.

Customers have the option to utilize the Help Center for self-help or contact the team via email and live chat for assistance with any inquiries.

| Customer Support Channels | Email, Chat, Phone |

| In-App Support Channels | “What’s New” tab, Help Center access |

| Other Support Resources | Blog, How-To Videos |

| Application Status Page | Yes |

FreshBooks Alternatives & Competitors

FreshBooks competes with other leading accounting software tools such as QuickBooks, Wave, and Zoho Books. In terms of usage and user experience, it bears similarities to Wave. Some alternative options include Xero, Sage Accounting, and QuickBooks Online.

QuickBooks Online

QuickBooks, serving over 4.8 million users globally, stands as a 5-star accounting software. QuickBooks Online provides advanced accounting features, facilitating easy access to excellent financial insights and ensuring data organization.

With its extensive user base, QuickBooks is widely regarded as the gold standard for small business accounting software.

Learn More: QuickBooks Review: A Leading Accounting Software

Wave

Wave is a widely used freemium accounting software known for its clean, intuitive, and user-friendly interface. The free plan offers accounting, invoicing, and receipt scanning functionalities.

Similar to FreshBooks, Wave allows users to send invoices, manage expenses, connect bank accounts, and track financial health through various reports.

However, Wave distinguishes itself by offering payroll services, a feature not available in FreshBooks.

Xero

Xero, a top accounting software, offers more features than FreshBooks. Serving over two million users, Xero offers invoicing, payroll, time tracking, and advanced inventory management capabilities.

While slightly pricier, Xero provides comprehensive tools customized for larger companies. However, it also comes with a more complex setup process and steeper learning curve.

Is FreshBooks Right For You?

FreshBooks is an excellent option for small service-based businesses, offering user-friendly features. However, it may not be suitable for larger businesses or those requiring advanced inventory management.

With pricing starting at just $15 per month, FreshBooks provides great value and is ideal for quickly setting up financial tracking. Its visually pleasing dashboard and easy navigation make it a top choice among accounting software options for small businesses.

FreshBooks Review Conclusion

FreshBooks is a popular accounting tool for freelancers, self-employed people, and small businesses in many different fields. It stands out because it’s easy to use, has strong invoicing features, and includes project management tools.

Moreover, unlike some competitors, most FreshBooks plans include automatic receipt capture and mobile mileage tracking at no extra cost.

Even without prior experience with accounting software, FreshBooks’ user-friendly design allows users to easily manage finances, improve cash flow, track expenses, and collect payments. Additionally, it simplifies tax preparation by providing necessary reports for tax filing.

Although FreshBooks doesn’t offer a free plan, it provides a generous 30-day free trial, allowing users to thoroughly test its features before committing. Furthermore, with a 30-day money-back guarantee, FreshBooks ensures a risk-free investment for users.

Meet Ay Lin, your tech-savings buddy! Discover awesome lifetime deals on digital products without any fuss. Ay Lin makes it easy-peasy to upgrade your digital game without emptying your wallet. Join the savings journey and elevate your digital experience effortlessly!