Running the finances of a small business is super important. You need good accounting tools that don’t break the bank. QuickBooks has been a favourite for small businesses for a long time. It’s affordable, easy to use, and has lots of features.

That’s why we are going to review QuickBooks Online which is the best choice for small business accounting. I hope this QuickBooks review will help you.

Pros and Cons Of QuickBooks

Pros

- QuickBooks Online’s market-leading position ensures widespread familiarity among accountants.

- Extensive integration with over 650 business apps, including major platforms like Amazon Business, Square, and Shopify.

- Comprehensive feature set, offering various built-in reports such as aged receivables, general ledger, profit and loss, and trial balance.

- Regular updates introduce new and advanced features, with upcoming plans for AI integration.

Cons

- Difficulty in upgrading from the Self-Employed plan, potentially requiring a switch to one of the Small Business plans as the business grows.

- Multiple subscriptions needed for managing multiple businesses.

- Limitations on the number of users allowed per plan, necessitating consideration of user access requirements when selecting a plan.

Why We Chose QuickBooks Online as Best for Small Businesses?

When it comes to managing finances for small businesses, QuickBooks stands out as the go-to choice. Many small business owners aren’t financial experts, so they need user-friendly tools.

QuickBooks Online covers all the bases with its wide range of features, including managing accounts receivable and payable.

One of the best things about QuickBooks Online is its versatility. It’s suitable for almost any type of business, offering features like project and inventory tracking. Plus, as your business grows, you can easily upgrade to higher service tiers.

Another advantage of QuickBooks Online is its flexibility. You can personalize your experience by integrating hundreds of apps that work seamlessly with it.

QuickBooks is also constantly improving. They’ve recently introduced Commerce Accounting, which simplifies connecting online sales channels like Amazon and Shopify. This reduces manual data entry, saving time and effort.

Excitingly, QuickBooks plans to incorporate AI into its platform soon, promising even more enhancements. Overall, QuickBooks Online remains a top choice for small businesses looking for reliable accounting solutions.

Ease of Use

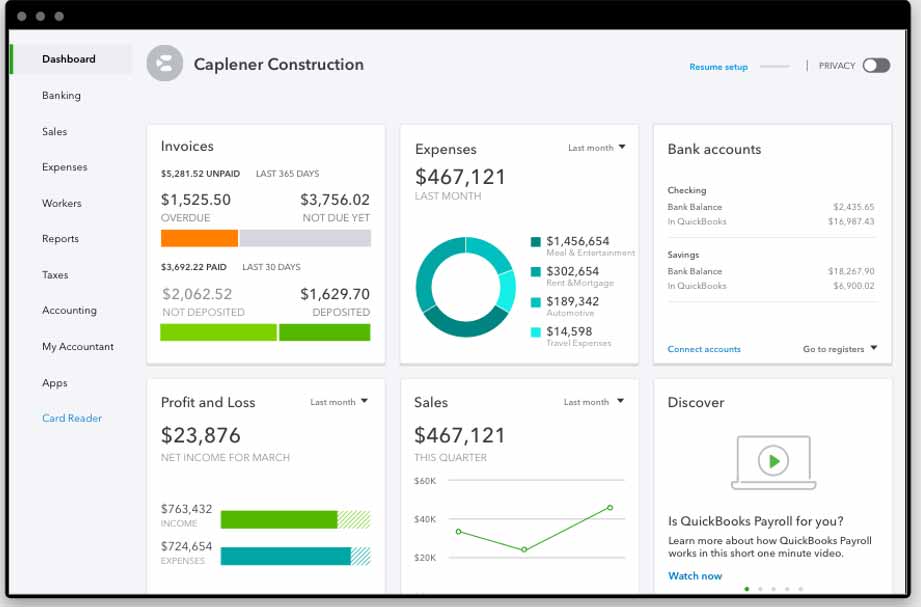

After trying out QuickBooks Online, we found it quite user-friendly. While the interface may seem a bit crowded due to its many features, it’s organized logically.

QuickBooks makes it easier for users to grasp GAAP accounting, especially for those without an accounting background, thanks to its handy data visualization tools.

The dashboard presents several graphs summarizing sales, income, expenses, and profit/loss data over time. You can click on these graphs to explore more details, and we appreciate the ability to adjust the date range for each graph.

Customizing invoices and forms is a easy task with QuickBooks. You have various templates, colors, fonts, and sizes to choose from. Moreover, you can upload your logo or brand image and position it as you like.

You also have the freedom to choose what information appears in the header, select which columns to include in the invoice body, adjust their labels and widths, personalize the text, and even add a message to your customers in the footer.

QuickBooks Online Features

Starting a business can be overwhelming, but having reliable accounting software can make a huge difference. QuickBooks Online shines above other options because of its advanced accounting features. Here are some key highlights:

1. Automation

QuickBooks Online impressed us with its exceptional automation tools, setting it apart from its competitors. For instance, if you’re unsure how to reconcile your business bank account, QuickBooks has got you covered.

Its automatic bank feeds import transactions from your business checking account and credit cards, and its intelligent reconciliation tools automatically match these transactions with the ones you’ve entered into the system.

Plus, you can create banking rules to further streamline this process. Another handy feature is the automation of payment reminders, recurring invoices, and bill payments. QuickBooks takes care of these tasks for you, saving you valuable time.

Additionally, it automatically backs up your data to the cloud, eliminating the need for manual backups. One standout feature we particularly like is QuickBooks’ ability to match transactions with foreign currency bank accounts.

In today’s globalized business landscape, this feature is invaluable for businesses operating internationally.

Overall, QuickBooks Online’s automation capabilities make it a top choice for businesses looking to streamline their financial management processes.

2. Invoicing

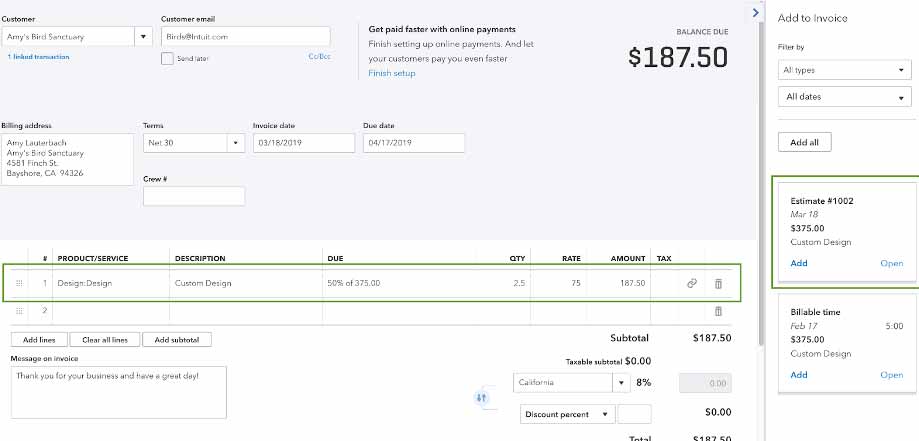

Crafting professional invoices can greatly impact your business’s cash flow. QuickBooks stands out for its thorough handling of invoice creation, offering robust features that surpass many competitors.

Here’s what sets QuickBooks Online’s invoicing functionality apart:

1. Mobile Optimization: QuickBooks ensures that its invoices are optimized for mobile devices, allowing you to create and send invoices easily both through the browser version and the mobile app.

Additionally, there’s an app integration that enables you to invoice directly from Gmail, enhancing convenience.

2. Invoice Payment Button: By setting up online payments through QuickBooks Payments or third-party service like PayPal or Square, you can include a payment button on your invoices.

This simplifies the payment process for your customers, making it quick and hassle-free.

3. Estimate Creation: QuickBooks Online offers a unique feature where you can create estimates for your clients. Once an estimate is approved, you can effortlessly convert it into an invoice with just one click.

The software automatically links related documents, ensuring organized billing and avoiding duplicate invoices.

4. Recurring Invoices and Payment Reminders: QuickBooks enables you to create recurring invoices and schedule automatic payment reminders. You can also track billable hours and include unbilled charges on your recurring invoices automatically, streamlining your invoicing process.

Overall, QuickBooks Online’s invoicing features provide comprehensive support for businesses, offering convenience, professionalism, and efficiency in managing billing tasks.

3. Inventory

QuickBooks Online offers great inventory features for Plus and Advanced plan users. You can easily manage inventory and vendors, and create purchase orders. Adding images of inventory items and bundling frequently sold products or services saves time.

Tracking inventory shows you how many items you have in stock when making estimates, invoices, or purchase orders. This is especially handy for businesses with lots of inventory.

The software alerts you when it’s time to reorder inventory, and when it arrives, QuickBooks converts the purchase order into a bill.

You also get on-demand reports, giving you real-time insights into your product performance. This helps you see which products are selling well and which ones need attention.

Overall, QuickBooks Online’s inventory features are a big help for managing your business smoothly.

4. Mobile App

QuickBooks Online mobile app is a fantastic tool for managing your business on the go. With it, you can access an overview of your business activity and handle various accounting tasks no matter where you are.

From viewing dashboard data to creating and sending invoices, accepting payments, capturing receipts and attaching them to expenses, reconciling transactions, viewing customer information, and even messaging customers directly from the app.

QuickBooks Online ensures you stay connected and in control of your finances wherever you are. It’s like having your entire accounting office in the palm of your hand.

5. Reporting

QuickBooks Online stands out in generating reports, surpassing many competitors in this aspect. It offers a variety of built-in reports such as aged receivables, general ledger, profit-and-loss statements, balance sheets, and trial balance reports.

What’s particularly impressive is the ability to set frequently used reports as favorites for quick access. Moreover, the software can automate the process of running reports and emailing them to you based on a schedule you create.

These reports provide valuable insights that can help you leverage data analytics to make informed business decisions.

QuickBooks Online’s robust reporting capabilities empower you to stay on top of your finances and drive your business forward with confidence.

6. Third-Party Integrations

What sets QuickBooks Online apart from many competitors is its wide range of third-party integrations. Instead of the hassle of manually exporting and importing data between QuickBooks and other business programs, you can seamlessly sync data between systems.

QuickBooks integrates with leading POS systems, popular e-commerce platforms, top CRM software, project management solutions, payroll systems, and much more.

With over 650 business apps in its integration ecosystem, QuickBooks offers unparalleled flexibility.

From Amazon Business to Square, Shopify to PayPal, QuickBooks Time to Fathom, and SOS Inventory, QuickBooks integrates seamlessly with all essential tools for modern businesses.

This extensive integration capability ensures that QuickBooks Online can adapt to your specific business needs and workflows, enhancing efficiency and productivity.

7. Security

We value QuickBooks Online’s commitment to data security, employing bank-grade measures to safeguard your information. With features like two-factor authentication and customizable user permissions, you have control over who accesses your system, adding an extra layer of protection.

Moreover, QuickBooks Online includes an audit log that tracks every login, logout, and file change, providing transparency and accountability.

These robust security measures are instrumental in preventing employee accounting fraud, ensuring the integrity of your financial data.

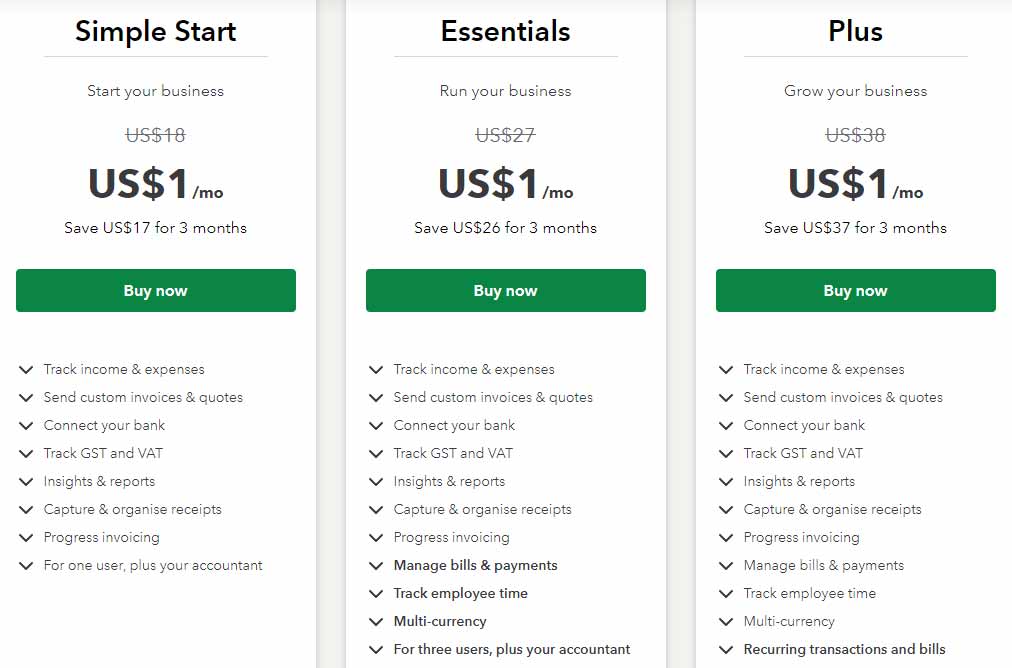

QuickBooks Online Pricing

QuickBooks Online is more expensive than many other accounting software. The basic Self-Employed package starts at $20 per month, while the most popular plan, which includes inventory tracking, is priced at $90 per month.

While other options like FreshBooks and Quicken may have similar basic features for less money, QuickBooks Online is known for its wide range of features and popularity among accountants, especially in the higher-priced market.

It’s worth noting that QuickBooks frequently offers discounts, so it’s advisable to inquire about any introductory offers before making a purchase decision. The prices mentioned above reflect the monthly costs without any discounts applied.

QuickBooks Online offers a range of plans tailored to different business needs:

1. Self-Employed Plan ($20/month): Ideal for freelancers and independent contractors, this basic plan includes income and expense tracking, receipt organization, quarterly tax estimating, basic reports, and miles tracking.

2. Simple Start Plan ($30/month): Designed for a single user, this plan builds on the Self-Employed features, adding cash flow analytics, tax deductions, sales tax calculation, and 1099 preparation tools.

3. Essentials Plan ($60/month): Supporting three users, the Essentials plan includes all Simple Start features, plus time tracking and bill pay and management tools.

4. Plus Plan ($90/month): The Plus plan, the most popular choice, supports five users and offers all Essentials features along with project profitability tracking and inventory management.

5. Advanced Plan ($200/month): Best for larger businesses, the Advanced plan supports up to 25 users. It includes all Plus plan features, along with additional perks like ‘Smart Reporting’ powered by ‘Fathom’, up to 20 classes, on-demand online training, a dedicated account team, and advanced workflow automation and data restoration capabilities.

QuickBooks offers payroll features for an additional fee on its small business plans. You can explore the software through a demo before making purchase. Desktop versions like Pro Plus ($549/year) and Premiere Plus ($799/year) are available, but they may lack some cloud-based features.

Consider your business needs carefully before choosing. Enterprise version pricing is available upon inquiry.

QuickBooks Live Bookkeeping

QuickBooks Online customers can access a live bookkeeping service. The cost for the first month includes accounting cleanup and onboarding, determined by sign-up month, tax filing status, and business start date.

Subsequently, monthly charges are based on the average monthly expenses over three consecutive months:

- Up to $10,000 monthly average expenses: $200 per month.

- $10,001 to $50,000 monthly average expenses: $300 per month.

- $50,001 or more monthly average expenses: $400 per month.

Implementation and Onboarding

QuickBooks Online offers a user-friendly setup process that stands out from competitors. You can start by taking a quiz on their website to determine the best plan for your business needs.

This personalized recommendation feature is a valuable addition.

Once you’ve set up your account or started a free trial, connecting your bank account to QuickBooks takes just a few minutes. For additional assistance, you can purchase a one-time session with a bookkeeper.

They’ll guide you through tasks like setting up your chart of accounts and automating processes, providing valuable support for less tech-savvy business owners at an affordable price.

Additionally, you have the option to speak directly with a QuickBooks representative for personalized help.

Customer Service

QuickBooks is known for its strong customer service, which is missing in many other cloud-based software options. You can reach out for assistance via phone or live chat, explore the comprehensive knowledge base on the company’s website, or seek advice from the community forum.

Additionally, you have access to tutorial videos, webinars, and training classes for further learning.

The company keeps users informed about new features and updates through monthly blog posts, along with articles relevant to small business owners.

For those who prefer in-person assistance, QuickBooks provides access to certified QuickBooks ProAdvisors who offer personalized support.

Overall, QuickBooks ensures that users receive good support and resources, making it a worthwhile investment in terms of customer service compared to some lower-priced alternatives.

Limitations

While QuickBooks remains the top accounting software solution, it does have some limitations to consider:

1. Challenging Upgrades from Self-Employed Plan: Transitioning from the Self-Employed plan, priced at $15 per month, to higher-tier plans can be cumbersome.

Upgrading involves downloading your data and reimporting it into QuickBooks, which adds unnecessary complexity to the process.

2. Lack of Niche Features: QuickBooks offers a more generalized, one-size-fits-all approach compared to some competitors. It may lack certain niche features that are important for specific industries, such as e-commerce businesses or those with high transaction volumes.

Businesses requiring robust time tracking for billable hours or focused on enterprise resource planning might find alternative solutions more suitable.

3. Limitations in Accounts Payable: QuickBooks lacks a comprehensive vendor network, limiting its effectiveness in managing accounts payable. Small business owners may need to supplement QuickBooks with additional software to address these limitations effectively.

Despite these drawbacks, QuickBooks remains a leading choice for many businesses due to its overall functionality and widespread adoption.

However, it’s important for users to evaluate their specific needs and consider alternatives if necessary to address any shortcomings.

Methodology

In our efforts to help small businesses find the right accounting software, we looked at many options carefully.

We checked things like how they handle payments and invoices, what other apps they work with, if they have good mobile apps, tools for making reports, how many people can use them, and how good their customer service is.

We also checked out their prices and if they offer free trials. To do this, we checked out the companies’ websites, tried out their software, and read what other users had to say about them.

We wanted to find software that gives small business owners the best value, is easy to use, and has features that make running their businesses easier.

Bottom Line

We recommend QuickBooks Online for:

- Business owners seeking widely recognized and widely used accounting software among accountants and bookkeepers.

- Businesses requiring seamless integration with various third-party applications.

We do not recommend QuickBooks Online for:

- Businesses unable to allocate at least $15 per month for accounting software.

- Niche businesses, such as those in e-commerce, that may need more specialized solutions rather than a mass-market, one-size-fits-all software package.

I hope this QuickBooks review will helpful for you for take the decision.

Meet Ay Lin, your tech-savings buddy! Discover awesome lifetime deals on digital products without any fuss. Ay Lin makes it easy-peasy to upgrade your digital game without emptying your wallet. Join the savings journey and elevate your digital experience effortlessly!