Are you having trouble handling your money? Lots of users find it hard to stay on top of bills, and other expenses! But there are tools out there that can make it easier to budget and keep tabs on your finances all in one spot.

Let’s take a closer look at Quicken review in this detailed review to see if its features are worth the price!

What Is Quicken?

Quicken stands out as a top-notch personal finance tool. It empowers you to manage your money wisely, taking charge of both your spending and saving habits. With Quicken, you pave the way towards the lifestyle you desire, reaching for financial independence with confidence.

Quicken has been helping people manage their money since 1983. Originally, it started as a simple program for DOS computers made by Intuit Inc. But in 2016, it was bought by Equiline Partners. Basically, Quicken is a tool to track your finances.

It’s really easy to use, which makes it great for beginners or anyone who wants to manage their money better. You just link it to your bank accounts, credit cards, investments, and other financial stuff, and it keeps everything updated automatically.

With Quicken, you can see where your money is going and how much you have left each month. It’s evolved a lot over the years, and now there are different versions for different needs.

Whether you use a Mac or Windows computer, or even if you prefer to use your phone or the web, there’s a version of Quicken for you. They even have versions for home use and for businesses.

Who Benefits From Quicken?

Quicken has grown in popularity as accounting software, catering to various types of users:

People Who Want Things Simpler

Quicken is a great choice for those seeking a straightforward budgeting tool that’s accessible on the fly. Unlike some competitors who bundle unnecessary features, Quicken offers customized solutions.

Introducing Simplifi by Quicken, the latest addition designed especially for budgeting newcomers seeking financial guidance.

Simplifi streamlines your expenses by automatically categorizing purchases, providing instant insights into your spending habits. Need groceries? Simplifi tracks it, helping you stay on budget. With alerts for overspending and unusual expenses, Simplifi and Quicken take the hassle out of managing your finances.

People Who Like Details

Quicken stands out as an excellent accounting software for those aiming to monitor their spending and gain insight into their monthly finances. With Quicken, users can easily create budgets and assess their financial performance, empowering them to effectively manage their money.

Investors

Quicken is highly favored among investors for its comprehensive features. Users can not only monitor their investment portfolios and track performance but also create detailed budgets tailored to each investment. This versatility makes Quicken a valuable tool for managing investments effectively.

Budget Newbies

Budgeting might feel overwhelming, especially if you’re new to it, but it’s not as hard as it seems. Quicken offers various options customized to different needs, so you can budget without getting overwhelmed by complex financial details.

For those seeking simplicity, Simplifi by Quicken is the perfect choice. It’s made to make budgeting easy without overwhelming you with money jargon or extra stuff you don’t need. Perfect for college students just starting or grads dealing with student costs, Simplifi gives you clear pictures and is handy for busy folks.

Moreover, Quicken isn’t just for personal finances; it’s also valuable for business owners. With Quicken, you can track both personal and business expenses in one place.

It allows you to categorize business expenses, such as office supplies, providing insight into your business spending effortlessly.

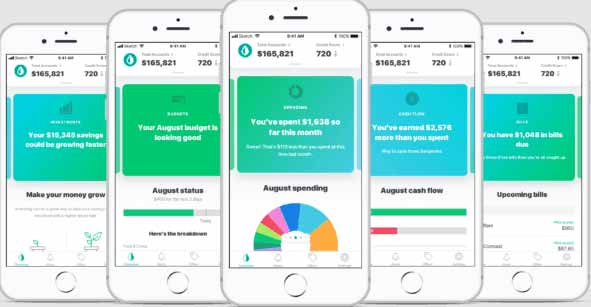

People Who Want Accessible Personal Finances

Many budget programs fall short when it comes to mobile accessibility, leaving users frustrated when they need to manage their finances on the go.

With Quicken’s Simplifi, designed for tech-savvy individuals, you get a mobile app that’s quick, practical, and available whenever you need it.

Now, you can quickly see how much you’re spending while shopping and make sure you’re staying on track with your financial goals.

Simplifi by Quicken puts your budget at your fingertips, making it convenient and efficient to stay on top of your finances anytime, anywhere.

People Who Don’t Trust the Cloud

Quicken is favored by those who prioritize privacy and prefer not to link their financial data with the cloud. For individuals who prefer keeping everything accessible on their computer and refrain from using mobile apps, Quicken offers a solution.

You have the option to manually input your transactions or allow Quicken to handle it for you, ensuring convenience while maintaining control over your personal information.

Quicken Pricing & Programs

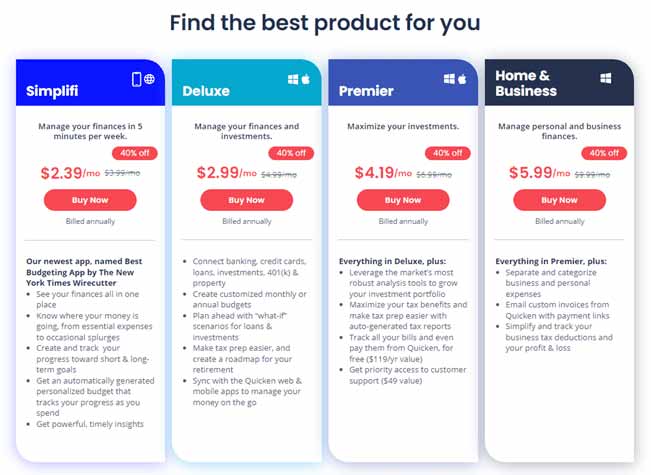

Quicken operates on a subscription model, offering four different packages with varying features and prices ranging from $28.68 to $71.88 annually. These subscriptions can be purchased from electronic stores, Quicken’s website, or through Amazon. Upon subscription, users receive automatic updates for one year across all versions of Quicken.

There’s a 30-day money-back guarantee, but canceling your subscription means losing access to automated downloads from financial institutions. Each package includes the Desktop version and a Quicken web & mobile companion app.

Users can create a simple one-month budget, sync bank accounts (if desired), and pay bills online using the bank bill pay feature.

The available packages are Simplifi By Quicken, Quicken Starter, Quicken Deluxe, Quicken Premier, and Quicken Home & Business, each offering distinct features tailored to different needs. Let’s delve into the specifics of each package!

Simplifi By Quicken

Price: $28.68 per year

Features:

- Simplifi by Quicken is optimized for web and mobile platforms, offering a user-friendly experience for budgeting beginners who prefer simplicity over complexity.

- Its key features include customizable monthly spending plans, visually appealing pies and graphs for easy tracking, intuitive financial reports, and basic investment account tracking options for portfolios.

- Unlike the Starter and Deluxe plans, Simplifi focuses on providing essential tools without overwhelming users with advanced investor features.

Quicken Deluxe

Price: $35.88 per year

Features:

Quicken Deluxe empowers users to generate personalized reports and monitor various financial aspects, including, investments, and retirement accounts.

Quicken Premier

Price: $50.28 per year

Features:

Quicken Premier offers all the features of Quicken Deluxe, along with the convenience of bill payment directly through the software and access to the current fair market value of your home via Zillow integration. Additionally, Quicken Premier provides priority access to Quicken support for enhanced customer assistance.

Quicken Home & Business

Price: $71.88 per year

Features:

Quicken Home & Business is specifically designed for Windows users, all features included in other Quicken plans. Additionally, users can manage invoicing, track business-related income and expenses, and navigate an intuitive dashboard displaying both personal and business financial data.

This plan offers several advanced features, such as:

- Rental property management, enabling users to oversee rental properties, track rent receipts, and manage tenant information.

- Personal property management, allowing users to input asset details and estimate their value.

- Tenant management, facilitating the recording of rental payments and tracking of tenant information.

- Vehicle management, where users can input car details including make, model, year, and mileage.

- Tools for monitoring security prices every 15 minutes and conducting investment scenario analysis.

Quicken Features

As with any personal finance app, Quicken continuously evolves to better serve its users. While the most recent changes were implemented in 2021 amidst the pandemic, many of these updates focused on refining existing features rather than introducing entirely new ones.

However, there are a few noteworthy updates that potential users may find appealing:

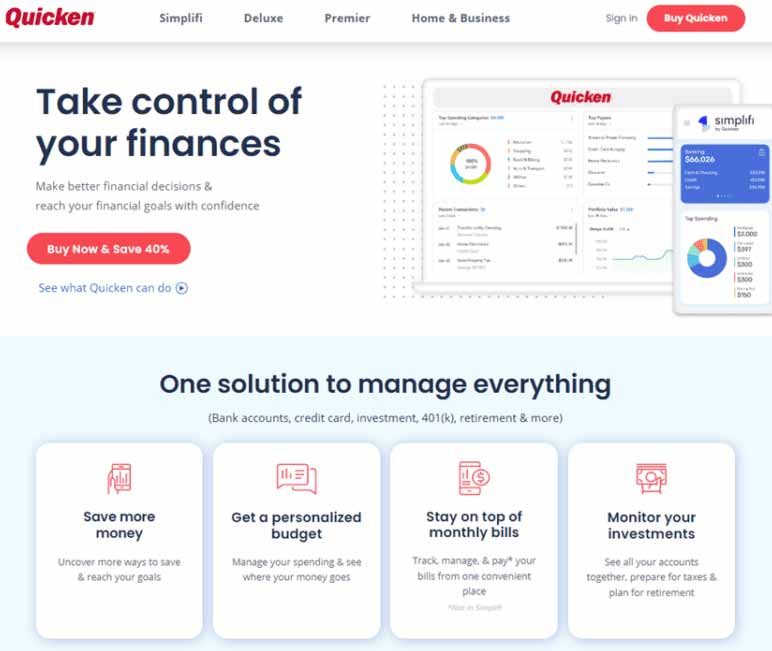

1. Tracking Spending/Expenses

Quicken recently updated its spending dashboard to make it easier for you to keep track of your money. Now, all your spending and expenses are conveniently displayed in one place. With this new feature, you can monitor all your accounts, ensuring your bills are paid on time and avoiding overspending.

But that’s not all! Quicken also allows you to categorize your spending by category, merchant, or date. You can even break it down by household members, making it simple to pinpoint where you might be overspending in your budget.

Additionally, Quicken provides added security by allowing you to review your transactions and verify their legitimacy. This extra layer of protection gives you peace of mind when managing your finances.

2. Financial Planning- Money Tracking

Financial planning with Quicken 2021 just got simpler! Now, you can easily create budgets, plan for the long term, and even tackle tax planning. Plus, with the Debt Reduction calculator, reaching your financial goals is within reach.

The budgeting tool in Quicken is a fan favorite. It lets you track your spending and savings, ensuring you stick to your budget. You can even set it up to generate a budget automatically based on your income and expenses.

Another handy feature is the Savings Goals tool. Whether you’re saving for a vacation or a new car, this feature helps you stay on track. You can set goals, deadlines, and see how much you need to save each month or year.

Quicken’s Tax Center is a game-changer. It provides all the information you need to file your taxes hassle-free. From reporting income and expenses to claiming deductions, Quicken has you covered. Say goodbye to tax season stress!

3. Bill Management (Bill Pay)

Managing bills is a crucial part of staying afloat financially, and Quicken makes it a breeze! With Quicken, you can easily handle your bills by paying them directly from your checking account.

In August 2020, Quicken transitioned from its old Bill Pay platform to the new and improved Quicken Bill Manager. This updated platform comes with the latest features and is accessible to Premium package users and above. Starter and Deluxe users can also access it by adding it to their packages for just $9.95 a month.

The Quicken Bill Management feature streamlines everything for you in one convenient place on the Bills dashboard. You can track your bills, make payments, stay updated on your account balances, and even download copies of your invoices.

With Quicken, you can make online payments securely through their service, whether it’s online or by mail, to anyone in the United States. Say goodbye to bill-related stress with Quicken’s efficient bill management system!

4. Investment Tracking

Quicken offers investment features for users on Quicken Deluxe, Premiere, and Home and Business plans. This software is invaluable for investors, providing insights into the performance of stocks, bonds, and even cryptocurrencies.

What sets Quicken apart is its connectivity to over 14 million financial institutions, ensuring real-time tracking of your investment changes. You can trust that your portfolio is always up to date.

One standout feature is Quicken’s ability to not only track investments but also calculate capital gains and losses on your portfolio options. This comprehensive approach helps you make informed decisions about your investments.

5. Retirement Overview

Quicken’s retirement tool provides a clear snapshot of your retirement accounts, offering insights into your financial future. You can easily track how much money is available to you at different times of the year and estimate your monthly income if you were to start drawing from your accounts today.

The 401(k) retirement tool is particularly useful for projecting the longevity of your current savings in retirement. While it doesn’t replace personalized financial advice, it’s a valuable resource for individuals approaching retirement who want to explore their options and plan accordingly.

6. Quicken For Mac

Quicken for Mac ensures that Mac users enjoy the same benefits without any problem. In the past, Quicken on Apple devices had its errors—slow graphs, delayed account linking, and more. But recent updates have transformed the experience, making it twice as fast with improved graph designs and portfolio views.

The new dashboard offers a seamless user experience, featuring five category cards: Income, Expense, Spending by Category, Recent Transactions, Uncategorized Transactions, and Top Spending Payee. While some users still believe the PC version runs smoother, many find Quicken for Mac to be perfectly adequate.

Personally, I primarily use it on my computer rather than the mobile app. The mobile app serves as a quick way to check all your accounts on the go, although occasional lagging may occur, albeit infrequently. Overall, Quicken for Mac delivers a satisfying experience for Mac users.

Account Synchronization

One of Quicken’s standout features is its ability to sync with all your personal finances, from investment accounts to credit cards. By linking your financial institution or other accounts, you unlock the full range of Quicken’s capabilities.

With everything in one place, there’s no need to go around multiple websites to check your account balances. The synchronization process is quick and easy, taking just a few minutes. Simply enter your information on the Quicken website, and it will connect your accounts and download all your transactions.

Then, you can pick which accounts and categories you want to sync up with Quicken and hit “Update Accounts.” Some folks worry about security, but Quicken’s got you covered with strong 256-bit encryption for your data. So you can handle your money without any worries.

Quicken Interface

Users love Quicken because it’s simple and easy to use. Its clean design and straightforward layout make it a breeze to navigate. Everything you need is right there on the home page, so it’s easy to find what you’re looking for.

For new users, Quicken offers a Resources page on their website where you can find tutorials and detailed information about various features, such as the One Step Update and the Investment Tracker. These resources are invaluable for getting started and making the most out of Quicken’s capabilities.

Signing Up With Quicken

Quicken operates on a subscription model, giving you access to financial tools and support for as long as you’re a subscriber. You can choose to pay monthly or annually for this service.

Signing up for Quicken is quick and easy, taking just about 5 minutes. Simply provide your name, email address, select a password and security question, and confirm acceptance of the terms of use. Once done, you can immediately access Quicken and start organizing your budgets efficiently.

If you’re unsure about Quicken, you can try it out with a 30-day trial before committing. However, if it’s not your cup of tea, there are plenty of other options available for tracking your finances.

Pros & Cons

Certainly, here are some key pros and cons of using Quicken:

Pros

- Security: Quicken ensures your information is always secure with bank-level security measures.

- Comprehensive Financial Overview: With Quicken, you can easily track all your spending and savings in one place, giving you a clear picture of your finances, including income, bills, net worth, and discretionary spending.

- Organization: Quicken helps you stay organized, especially if you have multiple bills or investments to manage.

- Budgeting and Bill Reminders: You can create budgets and set up bill pay reminders to ensure you stay on track financially.

- Excellent Customer Support: Quicken provides online support, live chat, email inquiries, and an active online community, making it easy to get assistance when needed.

- Small Business Version: Quicken offers a version specifically designed for small businesses, helping them track expenses and income related to their business.

- Investment Tools: Quicken provides investment tools to assist you in making informed decisions about where to invest your money.

- Bank Connectivity: Quicken allows you to connect directly to your bank and download transactions, helping you keep track of your account balance and avoid overdrafts.

Cons

- Cost: Quicken is not free. The full version of the software costs $5.99 per month, billed annually for businesses. There are free alternatives like Mint available, although they may have fewer features.

- Complexity: Quicken can be complicated for some users, especially those who are new to personal finance software. It may take time to fully understand and utilize all of its features.

- Subscription Model: Quicken operates on a subscription model, meaning you have to pay a monthly or annual fee to continue using the software. The price depends on the version of Quicken you have and the current subscription rate at the time of renewal.

- Feature Differences: The Mac version of Quicken may lack some features compared to the Windows version, which could be a drawback for Mac users. However, it has received high ratings from Quicken for Mac customers, especially in recent years.

- Compatibility Issues: Quicken may encounter difficulties syncing with certain banks, resulting in frustration for users who rely on this feature for accurate financial tracking.

Quicken Alternatives: Other Money Management Tools

If you’re unsure whether Quicken is the right personal finance app for you, don’t worry! While Quicken offers many benefits, there are also alternative options available to track your finances and manage your money effectively.

Mint

Mint is a free program supported by ads, offering many features similar to Quicken but with a simpler and less customizable interface. This makes it ideal for those seeking an uncomplicated tool to manage their finances.

Mint’s excellent mobile app allows you to monitor your investments conveniently while on the move. By connecting your bank, savings, and credit card accounts, you gain a clear understanding of your financial transactions and current balances anytime, anywhere.

For a more in-depth comparison between Mint and Quicken, you can read our Mint Vs. Quicken to determine which option suits your needs better. Whether you prioritize simplicity or customization, both Mint and Quicken offer valuable tools to assist you in managing your money effectively.

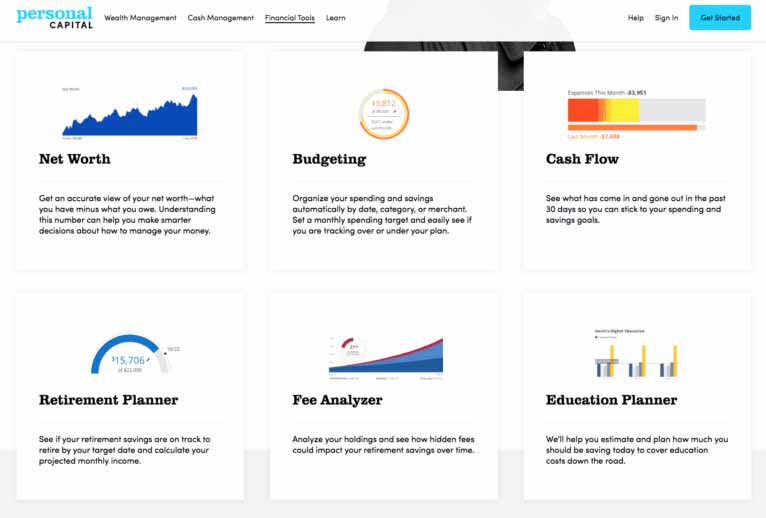

Empower (Formerly Personal Capital)

Empower is like an easy-to-use option instead of Quicken. It has both free and paid versions with extra stuff. But what really makes it different is how good it is at keeping track of investments.

What’s cool about Empower is that it doesn’t just help you watch your money coming in and going out, but it also has really helpful tools for keeping an eye on your investments, especially for retirement.

While similar to Mint in some respects, investors particularly appreciate Empower for its intuitive investment tracking features.

Just so you know, Empower talks a lot about managing wealth, which might not be what everyone wants. Some users stick with Quicken because they don’t want to deal with extra sales pitches and just focus on managing their money.

For a detailed analysis of Empower’s capabilities in managing both finances and investments, consider reading our in-depth Empower Review. This can help you determine whether Empower is the right choice for your financial needs and goals.

Final Thoughts

Looking for software to help with your money? Quicken is a great option. It helps you keep track of your spending, save cash, and handle investments. Lots of users like it because it’s easy to use, works on different devices, and has a bunch of features. But before you decide, make sure to think about how much it costs and if it might be a bit tricky to figure out.

Meet Ay Lin, your tech-savings buddy! Discover awesome lifetime deals on digital products without any fuss. Ay Lin makes it easy-peasy to upgrade your digital game without emptying your wallet. Join the savings journey and elevate your digital experience effortlessly!