Xero is great for businesses that are growing. It has different plans and features that work well for small businesses at different stages of growth. Discover the power of Xero in our Xero review. Learn how this cloud-based accounting software streamlines finances, boosts productivity, and simplifies business management. Explore features, pricing, pros, and cons to make informed decisions for your organization’s financial success

Here are some advantages of using Xero:

- Flexible Pricing: Xero’s pricing plans don’t depend on how many users you have. This means you can add employees without having to worry about the cost of the software going up.

- Extensive Integration: Xero integrates with over 1,000 business apps, making it easy to connect with other tools and systems you use for your business.

- User-Friendly Interface: Xero boasts a well-designed interface and layout that simplifies understanding complex accounting statistics, making it easier for users to navigate and manage their finances effectively.

Here are some drawbacks of using Xero:

- Limitations on Lowest Tier: The basic plan of Xero imposes caps on invoicing and bills. This may require many businesses to upgrade to a more expensive plan to meet their needs.

- Less Intuitive Invoice Customization: Compared to competing programs, customizing invoices in Xero may not be as intuitive, potentially making it more challenging for users to tailor their invoices to their specific preferences.

We’ve chosen Xero as the top accounting software for growing companies. Its pricing plans aren’t tied to the number of employees, making it perfect for businesses at different stages of growth. Xero is ideal for companies rapidly expanding their workforce, as they won’t need to fret about the number of users accessing the software within the organization.

| Xero Accounting Software Editor’s Rating | 9.1/10 |

|---|---|

| Payments | 9.0/10 |

| Automatic invoicing | 9.0/10 |

| Third-party integrations | 9.5/10 |

| Mobile App | 9.0/10 |

| 24/7 customer support | 8.5/10 |

Why We Chose Xero as the Best for Growing Businesses?

Starting a business usually means starting small, but as it grows, its financial needs change. Many business owners who aim for growth prefer to choose an accounting software solution and stick with it for the long term. Compared to others we’ve reviewed, Xero stands out for meeting businesses’ needs in all stages of growth.

One key difference with Xero is its pricing and plans, which are based on features rather than the number of users. In fact, all Xero plans support unlimited users, making it great for expanding businesses. Xero also integrates with over 1,000 third-party business apps, which is among the most integrations available in any accounting software package we reviewed. As a business grows, it often needs more integrations to scale up and keep operations smooth.

In our testing, we found Xero to be ideal for business owners with limited accounting knowledge. Despite its many features, Xero keeps things simple with a user-friendly interface and visual aids to assist new business owners. For these reasons and more, Xero is our top choice for accounting software for growing businesses.

Ease of Use

During our software testing, we found Xero to be incredibly user-friendly and easy to navigate. Its main dashboard provides key statistics that business owners need, such as the balance in their business account, outstanding invoices, pending bills, and current cash flow status.

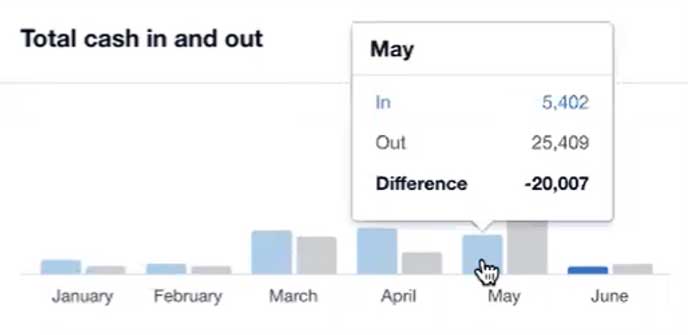

The interface is well-organized, with drop-down menus housing Xero’s features. While it may seem packed with features like other accounting software, such as QuickBooks, Xero stands out for its clarity in presenting information. For instance, its cash-flow chart uses colors to represent cash flow, making it simple for business owners to track their finances.

One standout feature is Xero’s avoidance of complex accounting jargon. Instead of using terms like “debits” and “credits,” Xero opts for straightforward language like “invoices owed” and “bills you need to pay.” This approach ensures that the software is accessible to all users, regardless of their accounting background.

Xero Features

Xero is designed to save business owners time by simplifying processes and offering tools to complete financial tasks more efficiently. Here are some essential accounting software features that Xero provides to make accounting less burdensome:

1. Recurring Invoices

One fantastic feature of Xero is its ability to schedule recurring invoices, also known as “repeating invoices.” You can customize these invoices by setting the send date, frequency, and end date, making it easy to automate regular billing cycles.

Moreover, Xero offers automatic payment reminders, which help encourage customers to pay on time. This feature saves you the hassle of following up on unpaid invoices. You can configure the software to send reminders before the payment is due or after it’s past due. Additionally, you can set up the system to automatically email receipts to your customers after receiving and recording payments, further streamlining your invoicing process and ensuring smooth transactions.

2. Online Invoicing

Overall, we were impressed with Xero’s invoicing capabilities, despite encountering a few minor inconveniences. One standout feature is its cloud-based system, which allows for easy editing of invoices without the need to resend them to customers.

Additionally, you can directly email invoices from the software, and Xero seamlessly integrates with popular payment processors like PayPal, Stripe, and Square, enabling you to accept online payments. However, we did find one drawback: customizing the look and feel of invoices is slightly less intuitive compared to competitors like FreshBooks, which specializes in generating invoices.

Since a professional-looking invoice is crucial for prompt payments, this may be something to consider for businesses that frequently send out invoices. Nevertheless, we found converting quotes to invoices straightforward, and Xero’s invoices feature drag-and-drop functionality for easy item reordering.

Another convenient aspect is the ability to attach files to invoices, such as documents or photos of completed work, further enhancing the invoicing process.

3. Inventory Tracking and Purchase Ordering

One aspect we appreciate about Xero is its inventory management feature, which provides visibility into your stock levels as you create quotes and invoices. This real-time information helps ensure accurate pricing and availability for your customers.

Moreover, if you need to replenish inventory, Xero simplifies the process by allowing you to effortlessly create and send purchase orders. These purchase orders can then be converted into bills for payment or invoices for your customers, streamlining your procurement and sales processes.

4. Smart Reconciliation

Xero’s smart reconciliation feature stood out to us as an impressive tool for streamlining the process of reconciling your business bank account. While most other accounting software providers offer some form of bank reconciliation, Xero goes a step further by utilizing machine learning to predict more accurate matches between bank transactions and those entered into the software.

Additionally, Xero offers bank rules and cash-coding features that further simplify and expedite the reconciliation process. These tools make it easier and faster to reconcile transactions, saving valuable time for growing businesses.

As businesses scale up and aim to become larger enterprises, automation becomes crucial for efficiency. Xero’s smart reconciliation tools play a significant role in automating tasks and can greatly assist growing businesses in managing their finances effectively.

5. Hubdoc

We really liked Xero’s special Hubdoc feature. It’s super handy because it helps you grab and save important information from documents. You just take a photo or upload a document, and the software does the rest, pulling out the important stuff.

Plus, it works seamlessly with lots of online banking apps, so you can easily bring in your transaction data. If you prefer, you can also grab transaction details from a PDF downloaded from your bank’s website. We think Xero’s Hubdoc is a great option, especially for business owners dealing with heaps of paperwork. It’s a solid alternative to Neat’s software, which does similar document scanning stuff.

Overall, Hubdoc’s ability to sync transactions with Xero is a real game-changer for busy business owners.

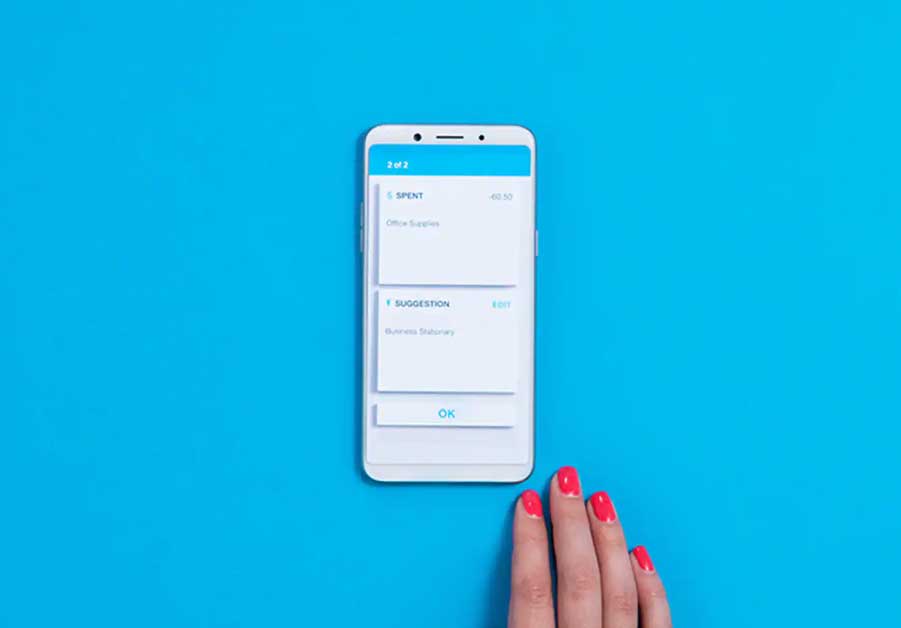

6. Mobile App

Not all accounting software we looked at have a mobile app, so we really appreciate Xero’s mobile app features. Their Accounting & Invoices app lets you do accounting tasks on your phone or tablet. With versions for both iPhone and iPad, you can check your cash flow, access customer and vendor contacts, reconcile transactions, and create invoices.

Plus, there’s even an Apple Watch app where you can see your account balances and new transactions. Customers seem to love it too, with a rating of 4.6 out of 5 on the Apple App Store, showing high satisfaction.

We’re also impressed by Xero’s Expenses and Projects apps, which come with the Established plan. These apps let you take photos of expenses, submit expense reports, track time, and link billable expenses and time to projects. They’ve got great ratings too, with Expenses at 4.6 and Projects at 4.8 on Apple’s app store. And the best part? They’re included in a cheaper plan than QuickBooks’ project management apps.

Overall, Xero’s mobile app functionality really stood out compared to other accounting solutions we looked at. It’s user-friendly, packed with features, and highly rated by customers.

7. Integrations

We were really impressed by Xero’s integrations. They offer over 1,000 integrations, which is one of the most extensive selections among the accounting apps we looked at. These integrations include popular services like Square, Stripe, PayPal, Gusto, DEAR Inventory, and Expensify.

Integrations are super useful for growing businesses because they allow you to enhance your digital setup as your business expands. If Xero doesn’t have a feature you need or if you want to connect it with other systems and services you already use, chances are you’ll find an add-on in Xero’s app marketplace. This flexibility makes it easy to tailor Xero to fit your specific business needs and workflow.

8. Transaction Monitoring

We were particularly impressed by Xero’s History & Notes feature, which adds an activity report at the bottom of every transaction screen. This nifty feature allows you to track important details about the document.

For instance, you can easily see if the invoice was copied from a quote, who created and approved it, and when they did so. Additionally, you’ll find details like the email address, date, and time for automatic payment reminders right on this screen.

What’s even better is that you can add your own notes, such as the expected payment date, making it even easier to keep track of important information and communication related to your transactions. This feature adds a layer of transparency and organization that can be incredibly valuable for managing your finances effectively.

9. Time Tracking

We valued Xero’s inclusion of time tracking in all its plans, which distinguishes it from many competitors like QuickBooks. Unlike other platforms where time tracking is often available only as a separate software or on more expensive plans, Xero offers this feature across the board.

Users can access time tracking through the free Xero Projects app, enabling them to record time and costs, and generate invoices and reports without any additional cost. While some time-tracking apps may provide extra functionality, we appreciated Xero’s straightforward and cost-effective solution.

It’s a convenient way for businesses to effectively manage their time and projects without exceeding their budget.

10. Reports

The landscape of businesses is being transformed by big data, with its impact on operations growing more significant each year. As businesses expand, there’s a growing need for data to be presented in a way that’s easy to understand, enabling business owners to make informed decisions based on insights.

During our software demo, we discovered that Xero’s reporting features are well-equipped to help users make sense of their data analytics. Xero’s reporting tool simplifies accounting data into easily understandable formats like bar charts, pie charts, and other graphs.

It offers several useful tools such as tracking your top 10 customers, managing budgets, and the ability to delve deeper into your most profitable revenue sources. Moreover, Xero allows you to export multiple reports for further analysis and sharing. This functionality empowers businesses to extract meaningful insights from their data, aiding in strategic decision-making processes.

11. Security

We value how Xero seamlessly connects to your bank and credit card accounts, importing data daily while prioritizing the security of your sensitive business information with bank-grade encryption. Furthermore, Xero offers the option for two-factor authentication, enhancing the security of your login credentials.

In addition to these security measures, Xero provides flexibility in managing user access by allowing you to set permissions for each employee added to your account. This empowers you to control and restrict the data they can access, ensuring confidentiality and integrity of your business data. Overall, these features contribute to a secure and reliable platform for managing your financial information.

Xero Pricing

Xero’s pricing stands out favorably compared to other accounting software options we reviewed. For instance, popular alternatives like FreshBooks and QuickBooks Online typically start at $15 monthly without any introductory discounts. In contrast, Xero’s entry-level plan comes in slightly cheaper at $13 per month.

What makes Xero particularly appealing for growing businesses is its tiered pricing structure. We appreciate that all Xero plans include nearly every available feature, such as estimates, accounts payable, and inventory management tools.

In contrast, some other accounting software we evaluated only offer these features in their top-tier plans. However, Xero’s top-tier plan offers three additional features: expenses, multicurrency support, and project tracking.

A notable advantage of Xero’s pricing model is that it doesn’t charge based on the number of users. With every Xero plan, there’s no limit on the number of users, making it an ideal choice for rapidly expanding businesses adding new employees.

Furthermore, Xero offers a 30-day free trial, allowing you and your team to test out the software before making a commitment. This is a feature that not every accounting software provider offers, so we value this opportunity.

Here’s a breakdown of each Xero plan:

- Early: This plan is priced at $13 per month. It includes access to Hubdoc and allows for up to 20 invoices and five bills per month.

- Growing: Priced at $37 per month, this plan includes everything in the Early plan, but with the added benefit of unlimited invoices, bills, and bank transactions.

- Established: The highest-tier plan costs $70 per month. In addition to everything in the Early and Growing plans, the Established plan includes expenses and projects functionality, as well as support for multiple currencies.

In addition to these plans, Xero partners with Gusto to provide additional HR functions such as payroll services. With Gusto, users can onboard new hires, administer employee benefits, track hours and paid time off, run payroll, and automatically file payroll taxes. The monthly base price for Gusto is $40, plus an additional $6 per person.

Implementation and Onboarding

During our trial of Xero, we found the setup process to be straightforward. New users can access a free 30-day trial without needing to provide credit card information, which we appreciated. What stood out was that the trial version of Xero is fully-featured, allowing users to test it out with actual data. This sets Xero apart from competitors that don’t offer such generous trial terms.

Once signed up, Xero provides several guided tutorials to help users get acquainted with its tools. These tutorials cover various aspects, such as connecting your business bank account, adding customers, and creating invoices.

We also liked that many pages within the app include how-to videos and links to step-by-step guides, making it especially helpful for business owners who may not be very tech-savvy. Overall, the user-friendly setup process and abundance of resources make it easy for users to get started with Xero.

Customer Service

Overall, we were satisfied with the customer support options provided by Xero, although they were not as comprehensive as those offered by QuickBooks Online. Unlike QuickBooks, Xero does not offer immediate phone support; instead, you need to reach out to customer service first via email or live chat, after which you may be directed to a phone-based representative if necessary.

Xero’s customer service has a Trustpilot score of 4.3 out of 5, with many users praising the fast response time. This quick turnaround is beneficial for growing businesses that can’t afford to waste time on technical issues.

During our trial, we contacted Xero via email and were eventually directed to a representative by phone. We found the agent to be extremely helpful and knowledgeable about Xero’s features.

In addition to live assistance, Xero provides access to a wealth of online support resources, including videos, a blog, podcasts, small business guides, and training courses. Recently, Xero has streamlined its search functionality within the software, allowing users to find help without leaving the site. These resources are valuable for users seeking to maximize their understanding and utilization of Xero’s features.

Limitations

While Xero is indeed an excellent accounting solution, we did come across some limitations during our evaluation:

- Cap on Invoicing and Billing: Compared to alternatives, Xero imposes caps on invoicing and billing for its lower-tier plans. For example, the Early plan only allows you to send 20 invoices and five bills per month, which we found to be unusually low. In contrast, FreshBooks offers unlimited invoicing to five customers on its lowest-tier plan. To remove these caps, users will need to upgrade to Xero’s higher-tier plans.

- Expense Tracking: The Early and Growing plans do not include expense tracking functionality. Users will need to upgrade to the Established plan to access this feature.

- Niche Limitations: While Xero offers a comprehensive set of features, it may not cater to businesses with niche requirements. For instance, businesses that need to track billable hours or send invoices immediately might find FreshBooks more suitable. Similarly, businesses focused on enterprise resource planning (ERP) may prefer Oracle NetSuite.

- Accounts Payable Limitations: Xero lacks a comprehensive vendor network, limiting its effectiveness in the accounts payable space. Since processing accounts payable is crucial for business operations, small business owners may want to consider supplementing Xero’s capabilities with additional software.

These limitations highlight areas where Xero may not fully meet the needs of certain businesses. However, despite these drawbacks, Xero remains a strong accounting solution for many users.

Methodology

In our quest to assist small businesses in selecting the ideal accounting software, we conducted thorough research and analysis of numerous options in the market. Our methodology involved evaluating various software features including payment and invoicing capabilities, integrations, mobile apps, report generation, supported user count, and customer service options. Additionally, we considered pricing structures and the availability of free trials.

To generate our quantitative score and use case, we meticulously reviewed information from multiple sources including the company’s website, software demos, and user reviews. By incorporating independent opinions on the software’s strengths and weaknesses, we ensured a comprehensive understanding of each solution’s performance.

Specifically focusing on growing businesses, we paid close attention to pricing tiers, the extent of integrations offered, and the range of features and tools available. Our goal was to provide small businesses with reliable guidance in selecting accounting software that aligns with their evolving needs and facilitates their growth journey.

Bottom Line

We Recommend Xero for:

- Growing businesses that are rapidly adding employees: Xero’s pricing model, which doesn’t charge based on the number of users, makes it an excellent choice for businesses experiencing rapid growth and adding new employees.

- Businesses that need their accounting software to integrate with many different third-party apps: Xero’s extensive selection of integrations, with over 1,000 options available, ensures seamless connectivity with various third-party apps, providing flexibility and efficiency in managing business operations.

- Less accounting-savvy business owners who prefer lots of color-coded visuals to help them analyze their business’s performance: Xero’s user-friendly interface, featuring color-coded visuals and intuitive navigation, is ideal for business owners who may not have extensive accounting knowledge but still want to easily interpret and analyze their financial data.

We Don’t Recommend Xero for:

- Businesses that need a low-cost way to send many invoices or bills: Xero’s lower-tier plans impose caps on invoicing and billing, making it less suitable for businesses that require a high volume of invoicing and billing at a lower cost.

- Niche businesses (such as those in e-commerce) that require more specialized solutions instead of a mass-market, one-size-fits-all software package: While Xero offers a comprehensive set of features, it may not fully meet the specialized requirements of niche businesses, such as those in e-commerce, which may benefit more from tailored solutions designed specifically for their industry needs.

Xero FAQ

Xero is an accounting software package designed to help small businesses manage their finances. It offers bookkeeping, invoicing, business analytics and more.

Whereas QuickBooks is the market leader in the U.S., Xero holds a major market share in countries such as Australia. Both software packages offer many features and integrations, but Xero is slightly less expensive and allows unlimited users.

Xero features a user-friendly interface and avoids confusing accounting jargon, making it an excellent choice for users who are not tech-savvy or who do not have deep knowledge of accounting.

Meet Ay Lin, your tech-savings buddy! Discover awesome lifetime deals on digital products without any fuss. Ay Lin makes it easy-peasy to upgrade your digital game without emptying your wallet. Join the savings journey and elevate your digital experience effortlessly!