If you’re running a small business and need accounting software that’s easy on the pocket, Zoho Books is a great choice. It’s budget-friendly and comes with a straightforward online app. With Zoho Books, you can quickly make and send invoices, keep tabs on expenses, and link up your accounts without any hassle.Discover a comprehensive Zoho Books review – explore its features, pricing, pros, and cons. Find out if Zoho Books is the right accounting solution.

Pros

- Zoho’s ability to automate financial functions is almost unparalleled among the accounting software products we reviewed.

- Tech-savvy business owners will love that the software includes its own scripting language to code custom functions.

Cons

- Zoho requires coding abilities to make the most of its automation features, which may be challenging for business owners who aren’t tech-savvy.

- The cap on the number of monthly transactions and users may dissuade high-volume, employee-heavy businesses from using the software.

In 2024, we’ve selected Zoho Books as the top accounting software for microbusinesses. Here’s why:

- It’s budget-friendly and allows you to effortlessly create, send, and monitor invoices.

- Zoho Books features a user-friendly client portal, facilitating real-time collaboration between you and your clients online.

- If you’re a small business owner seeking reliable accounting software, this review will guide you through Zoho Books and why it stands out as the best choice for microbusinesses.

| Zoho Books Accounting Software Editor’s Rating | 8.5/10 |

|---|---|

| Affordable Pricing | 10/10 |

| Free trial | 10/10 |

| Integrations | 10/10 |

| Invoicing and bill pay | 10/10 |

| Mobile app | 5/10 |

Accounting software is crucial for freelancers, entrepreneurs, and microbusinesses, just as it is for larger companies. When choosing the right software for a microbusiness, it’s essential to consider both affordability and ease of use. In our search, Zoho Books emerged as a top-notch accounting solution tailored specifically for microbusinesses.

Why Zoho Books Is Best for Microbusinesses?

Not every accounting software suits very small businesses. Some are too complex, powerful, or pricey, while others simply don’t cater to microbusiness needs. Freelancers, consultants, sole proprietors, and those running e-commerce or home-based businesses need software that fits their requirements without being overwhelming or costly.

Price is a big factor, especially for microbusinesses. Thus, we sought software that’s affordable yet highly functional. We aimed for a scalable solution that small businesses can grow with, offering options to upgrade and integrate with other business tools.

Additionally, having a mobile app was crucial for busy entrepreneurs to manage their accounting tasks on the move. After extensive research and analysis, we found Zoho Books to be the top pick for microbusiness accounting software.

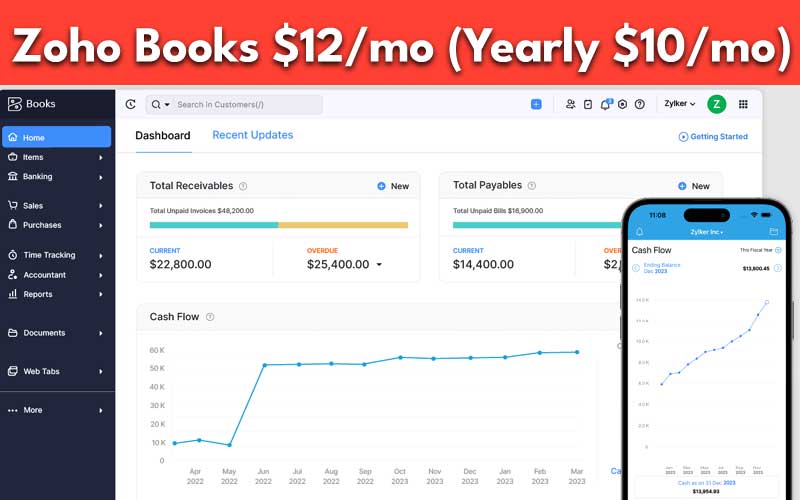

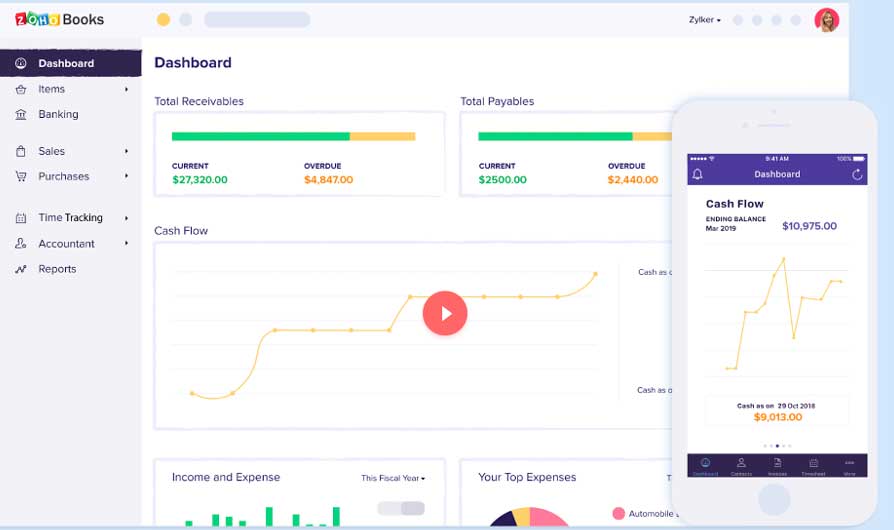

Zoho Books provides a user-friendly dashboard with simple visualizations to help you grasp your business’s financial status quickly. These visuals are also accessible through the mobile app, ensuring you can stay informed on the go.

Usability

Zoho Books is packed with features tailored for microbusinesses, such as automation of accounting processes, invoicing, online payment capabilities, and tools for tracking time. What sets it apart is its extensive mobile app support, including compatibility with the Apple Watch.

One major time-saving aspect of Zoho Books is its automation capabilities. You can configure the software to handle recurring tasks like sending invoices and payment reminders, as well as tracking expenses and alerting you about upcoming bills. Bank rules can be set up to automatically categorize transactions from your bank feed, and the software even suggests matches during account reconciliation.

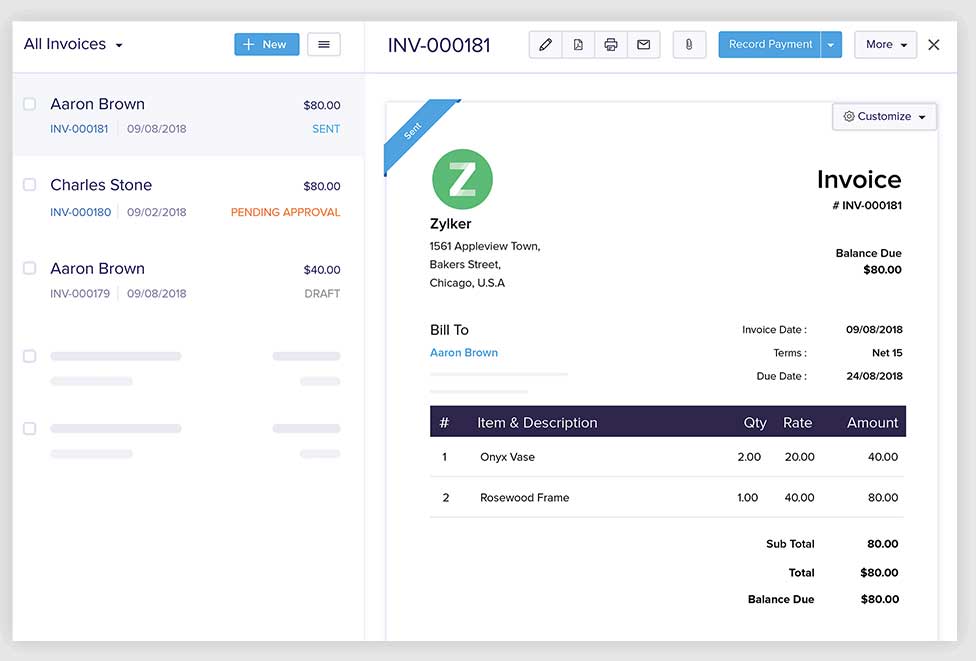

A standout feature is the ease with which you can convert sales orders or estimates into invoices with just a few clicks, then customize them as needed and schedule them for future sending. The software also maintains an audit trail, detailing linked transactions, user actions, and timestamps.

However, it’s worth noting that this feature is restricted to users in certain regions like the U.K., EU, UAE, KSA, and India, which may disappoint customers in other areas where such functionality is more widely available in competing platforms.

Zoho Books Features

| Workflow automation | Automation tools streamline repetitive tasks — such as sending invoices and payment reminders or reconciling accounts — and take them off your team’s plate. |

| Invoicing | Zoho Books offered some of the easiest-to-use invoicing tools we found in our review of accounting software. |

| User-friendly dashboard | A clear and user-friendly dashboard displays a comprehensive overview of your business’s financial health. |

| Online payments | Online payment integration makes it easy for your business to pay bills and accept payments from clients. |

| Client portal | The Zoho Books client portal offers a self-service space that creates a seamless experience for your clients to receive proposals, view project estimates and connect with your team. |

| Mobile application | A well-designed mobile application makes it easy to access the core features of Zoho Books anytime, anywhere. |

1. Workflow Automation

Microbusiness owners juggle numerous tasks, so time-saving solutions are crucial. Zoho Books streamlines your workflow by automating accounting tasks. Its automation tools allow you to schedule recurring invoices and send automatic payment reminders to clients with outstanding bills.

You’ll also receive reminders for your own bills. Plus, Zoho Books handles account reconciliation, sparing you the effort of manually checking for errors in your records

2. Invoicing

A standout feature of Zoho Books is its incredibly simple process for converting sales orders and estimates into invoices. With just a few clicks, you can effortlessly transform them, and then customize them further by dragging and dropping elements as needed.

The software also saves your information for future use, making it even easier to create similar invoices in the future. We found this invoicing functionality to be on par with the tools in our review of FreshBooks, which is renowned for its invoicing capabilities.

3. User-Friendly Dashboard

In accounting software, a user-friendly dashboard is key, and Zoho Books delivers just that. While its dashboard may appear minimalistic compared to others, it still provides vital details like income, expenses, receivables, payables, and cash flow.

The design is clean and avoids overwhelming users with excessive information. For microbusiness owners, it’s crucial that data is presented in a way that’s easy to grasp quickly, as they often lack dedicated financial teams.

Zoho Books excels in this regard, offering organized visualizations that provide the essential information you need at a glance.

4. Online Payments

Ensuring prompt and secure payments is crucial for microbusinesses, and Zoho Books simplifies the process. With just a few clicks, you can set up online payments by selecting your preferred integration from a range of options including Stripe, PayPal, Authorize.Net, and more. This comprehensive list of payment gateways ensures flexibility and convenience for your business’s financial transactions.

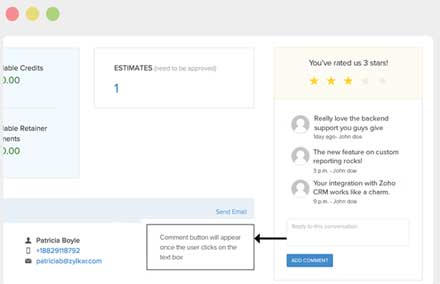

5. Client Portal

Customer service is vital for microbusinesses, and Zoho Books excels in this area with its client portal feature. This dedicated space allows your customers to access and manage their transactions, request project estimates, provide feedback, and engage in real-time interactions.

By offering a self-service platform, the client portal streamlines communication between your customers and your team, freeing up your resources for more complex tasks while still providing excellent service.

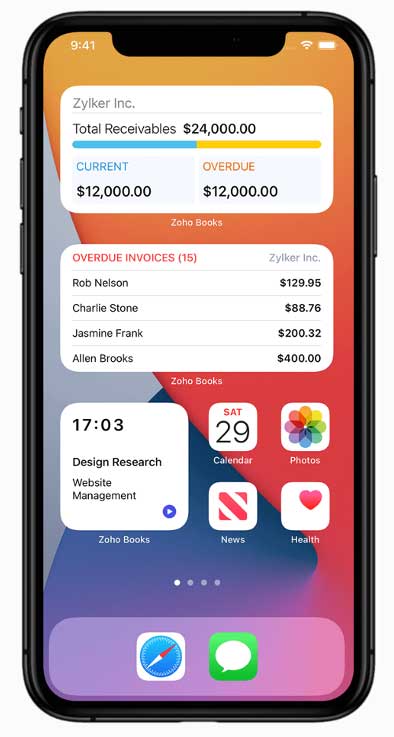

6. Mobile Application

Most accounting software provides mobile apps for on-the-go business management, and Zoho Books is no exception. With the Zoho Books app, you can handle payments, track payables, access instant insights, generate financial reports, and send invoices—all from your mobile device.

Additionally, you have the option to add widgets to your device’s home screen for quick access. Best of all, the mobile app is available for both iOS and Android devices at no extra cost.

Zoho Books Cost

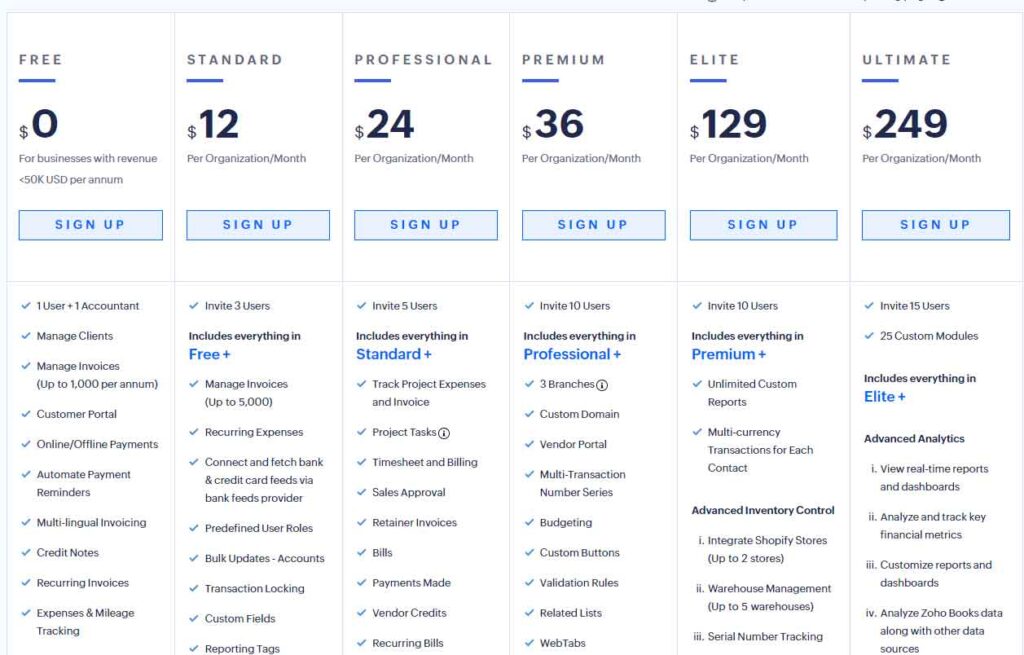

Zoho Books provides various pricing plans, but what sets it apart is its free version, unlike many others that only offer free trials. Microbusinesses with revenue under $50,000 can utilize Zoho Books at no charge. This is a significant advantage for business owners starting out, offering them a cost-effective solution to manage their finances effectively.

Zoho Books offers a range of pricing plans tailored to different business needs:

- Standard: Priced at $15 per month, this plan supports three users. It includes features such as managing up to 5,000 invoices, reconciling transactions, creating invoices, tracking mileage and expenses, and managing projects and timesheets.

- Professional: At $40 per month, this plan supports five users. It encompasses all features of the Standard plan, with additional capabilities like creating sales orders, managing purchase orders, and handling multiple currencies.

- Premium: Costing $60 per month, this plan supports 10 users and includes everything from the previous plans, along with a vendor portal, a custom domain, budgeting tools, and integration with Zoho Sign and Twilio.

- Elite: Priced at $120 per month, this plan also supports 10 users and offers advanced features such as cash flow forecasting reports, advanced inventory control, and email, voice, and chat support.

- Ultimate: This plan, priced at $240 per month, supports 15 users and includes all features from the Elite plan. Additionally, users receive 25 custom modules, advanced analytics, real-time reports and dashboards, the ability to embed reports in websites, and more.

Furthermore, users can add extra users to any plan for an additional $2.50 per user per month. If your customers prefer hard copies of estimates or invoices, but you don’t want to handle printing and mailing yourself, Zoho Books offers a solution. You can purchase snail mail credits for $2 each, and Zoho will handle the mailing for you.

Additionally, Zoho Books offers an auto-scan feature as an add-on for $8 per month, providing 50 scans per month. This feature automatically scans documents you upload, like receipts or vendor invoices, and uses the data to create new transactions.

While some other software platforms offer similar features for free, such as the one reviewed in our Xero review, Zoho Books provides this convenient option at an additional cost.

Zoho Books Setup

New users can easily create an account by clicking on the sign-up button. The setup page allows you to select your time zone and input your company information. You can then choose the modules that suit your business needs. If you want to receive payments through the platform, you can integrate apps like PayPal.

One of the major advantages of Zoho Books is its user-friendly interface, featuring a clear and easy-to-navigate dashboard. You’ll have quick access to key financial insights through widgets displaying receivables, payables, expenses, billable hours and expenses for projects, and a cash flow chart. A helpful welcome video guides you through the sign-up process.

To experience Zoho Books firsthand, you can sign up for a free 14-day trial with no credit card required. Additionally, you can learn more about the software by watching webinars and tutorial videos provided by the company. We recommend taking advantage of the free trial to familiarize yourself with the platform and its benefits for your business.

Zoho Books Customer Service

Zoho Books offers a range of support options to cater to your needs. For users in the U.S., the U.K., Australia, India, and various other countries, email, live chat, and 24-hour phone support are available five days a week. This 24-hour support is included in Zoho Books’ Premium or Enterprise customer support plans.

Otherwise, phone support operates from 9 a.m. to 5 p.m. Monday through Friday. Additionally, you can access assistance online through Zoho Books’ searchable knowledge base and customer forums. Furthermore, Zoho Books provides a comprehensive help documentation center containing guides, how-to’s, tutorials, and videos to assist users in navigating the system.

These resources are invaluable for resolving basic queries independently. Particularly helpful topics include setting up custom invoices, branding and logos, user roles and permissions, and online payments, ensuring users can start using the platform effectively right from the beginning.

Zoho Books Drawbacks

One of the main drawbacks of Zoho Books is its limited functionality as businesses expand and require more advanced features. For instance, all Zoho Books plans impose a maximum limit on the number of invoices you can issue per year.

Moreover, Zoho Books lacks features for calculating various types of taxes besides sales tax. This necessitates giving your accountant regular access to your books to handle tax calculations and ensure timely filing and payment. Additionally, customers in many regions do not have access to Zoho Books’ audit logs, a feature offered universally by competitors like QuickBooks Online.

For businesses that outgrow Zoho Books, alternatives like QuickBooks Online or Oracle NetSuite, which offer more comprehensive and advanced features, may be worth considering. However, small businesses might find these solutions to be excessive for their needs.

Methodology

In our search for the best accounting software for microbusinesses, we prioritized affordability, user-friendliness, and a comprehensive set of core accounting tools. After thorough research and analysis, we concluded that Zoho Books is the top choice for microbusinesses. Not only does it offer a range of easy-to-use features, but it also provides a free version for businesses with annual revenue under $50,000.

Overall, Zoho Books stands out as a simple yet effective accounting software solution that caters to the needs of microbusinesses without placing excessive demands on time and resources for business owners.

Overall Value

We recommend Zoho Books for

- Small businesses operating on a budget.

- Users seeking a straightforward platform.

- Users who prioritize setting up accounting software quickly and easily, without a steep learning curve.

We don’t recommend Zoho Books for

- Businesses that have outgrown basic accounting software solutions and require more advanced features.

- Businesses that would be limited by a cap on their monthly invoicing volume.

- Businesses that cannot afford an accountant to handle quarterly and annual business tax calculations and filings.

Zoho Books FAQ

As of now, Zoho Books serves approximately 13,000 customers. However, when considering all its products, Zoho boasts a vast customer base of over 80 million globally. Among these customers are microbusinesses that require basic accounting software tools.

Absolutely! Zoho Books offers a 14-day free trial, granting access to all features. Moreover, there’s a free plan tailored for businesses with less than $50,000 in annual revenue. This ensures that businesses can explore and utilize Zoho Books’ capabilities without financial constraints.

Indeed! Within Zoho Books’ settings, you can utilize the users and roles tools to enter your accountant’s email address, provide them with access, and configure their user permissions. This feature allows seamless collaboration with your accountant while maintaining control over the level of access they have within the platform.

Meet Ay Lin, your tech-savings buddy! Discover awesome lifetime deals on digital products without any fuss. Ay Lin makes it easy-peasy to upgrade your digital game without emptying your wallet. Join the savings journey and elevate your digital experience effortlessly!